10/11/2025

10/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

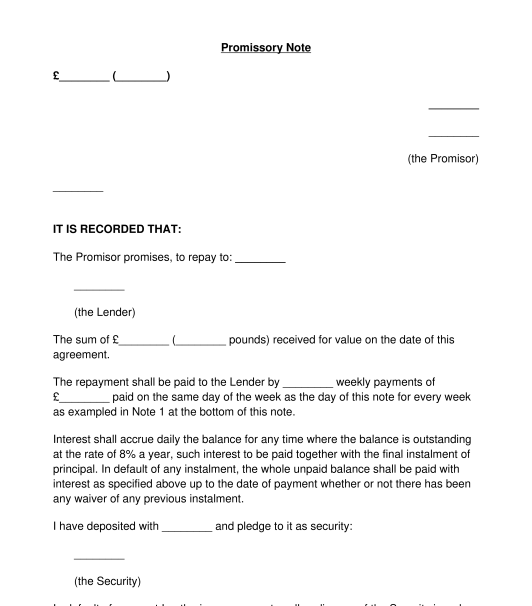

A promissory note can be used to confirm the details of a simple loan between individuals or corporate entities in the United Kingdom. It acts as an 'I owe You' (IOU) and constitutes a promise for a borrower to make payment.

A promissory note is a simplistic note which is signed by a borrower (the person or entity borrowing the money). It is typically used in less complex and less formal situations, in order to confirm that the relevant loan amount will be repaid. Promissory notes are often used between friends and family members. The loan under a promissory note can usually be transferred to another third party.

A loan agreement is a formal contractual document which will be signed by both the borrower and the lender. The loan cannot usually be transferred to another third party. A loan agreement can include more detailed information about the details of a loan as:

No. A party can agree to lend another party money informally, without any written documentation. However, it is helpful to have a promissory note to set out the basic details of the loan amount and the agreement about repayment. This can be helpful evidence of the contractual agreement in the event of any future dispute

The lender and borrower can be a:

It is also possible to have multiple borrowers in the agreement who are jointly responsible for the repayment of the loan.

A promissory note is designed to remain in place until a loan is repaid. The parties can agree that the loan will be repaid by:

Once the borrower has signed the promissory note, the parties should retain a signed copy of this. The borrower should make repayments following the agreement.

If the loan is not repaid in time, or if any payments due are missed. The lender may wish to send a letter of demand.

If amounts remain unpaid following a letter of demand, the lender might wish to send a formal breach of contract warning notice that the contractual agreement has been breached. If the matter remains unsolved, the lender may wish to send a letter of claim, before then instigating court proceedings.

A promissory note should:

The law that is most relevant to a promissory note in the United Kingdom can be found in The Bills of Exchange Act 1882.

The general laws of contract will also apply.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Promissory Note - Sample, template - Word & PDF

Country: United Kingdom