01/12/2025

01/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

01/12/2025

01/12/2025

Word and PDF

Word and PDF

1 page

1 page

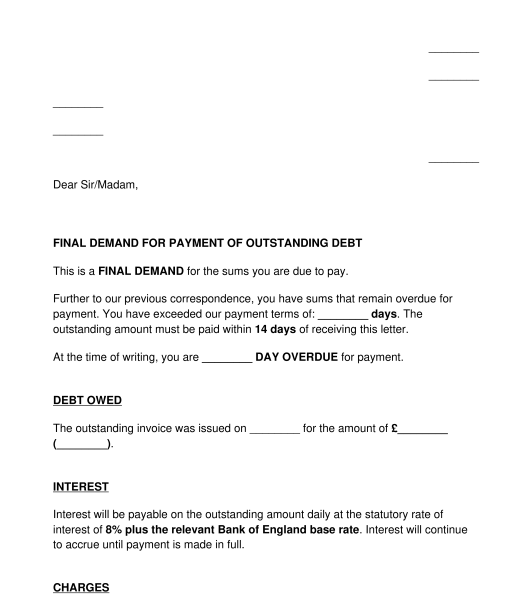

A letter demanding late payment of debt (letter of demand) can be used by a business to make a formal request for the payment of a commercial debt. The letter may be used where both the creditor (the organisation which is owed money) and the debtor (the organisation which owes money) are acting in the course of business in England and Wales.

A letter of demand is used to make a formal request for the payment of commercial debt.

Under the pre-action procedure (the process that must be followed before a civil court claim is issued) a formal letter of claim should be sent following any final demand for payment. A standard letter before claim can be used for commercial debts (and other types of claims).

No, but it is best practice to send this kind of letter before any final letter before claim and before any court claim is made in the Civil Court. This helps the creditor to evidence that they have attempted to resolve matters.

It is possible to claim recovery costs on late commercial debts (late payment compensation). These costs are payable to cover the creditor's costs incurred in recovering the debt. The amount of compensation that can be charged will depend upon the amount of debt:

The creditor must be a business (or a local authority) that is claiming debt from another business. A business can include a sole trader, provided that the relevant debt arose from a contract regarding the sale of goods or services where both parties are acting in the course of business.

Once the letter has been completed and has been signed, it should be sent to the debtor by the creditor. The letter can be printed, signed and sent to the debtor via post. It is also acceptable to electronically sign the letter and send it via email. A creditor may also choose to send the letter by both methods to minimise the chances of the debtor arguing that it did not receive the letter.

Although the relevant debt figures will be summarised in the letter, it can be helpful to include all relevant invoices.

If a debtor fails to make payment following a final demand, the creditor may wish to commence the pre-action process before any court claim is made in the Civil Court.

A commercial payment will be considered late following the relevant statutory or contractual provisions (the payment terms).

If the payment terms/contract specifies a payment date, this should be within 30 days for public authorities or within 60 days for other business transactions.

Where no payment terms have been explicitly agreed, the law will imply a payment period and the payment will be due 30 days after either:

Interest refers to the money that is added to and charged on a debt. Often, interest accrues once a payment becomes late. Interest is calculated with reference to a percentage, usually at an annual rate.

For commercial debts, statutory interest can be claimed on late payments. This means that the law sets out the amount of interest that may be claimed (in the absence of any explicit contractual agreement). The rate of statutory interest is the annual rate of 8% plus the base rate*. The government website shows how statutory interest can be calculated.

Alternatively, a contractual agreement/the terms of payment can fix the rate of interest that may be claimed.

The base rate is the rate of interest set by the central bank: the Bank of England.

The letter should:

The main legal provisions that apply to late payments of commercial debts are:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Letter Demanding Late Payment of Debt - Template

Country: United Kingdom