22/11/2025

22/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/11/2025

22/11/2025

Word and PDF

Word and PDF

1 page

1 page

A letter to acknowledge an outstanding debt is a formal letter sent by a person who owes a debt, confirming the debt and promising to repay the debt.

The acknowledgement of debt would be useful where a debtor under a loan agreement has not yet settled the debt. This letter of acknowledgement of debt serves to inform the creditor that the debtor intends to pay and specifies the expected repayment date.

A loan agreement is a legally binding contract between a lender and a borrower, detailing the terms and conditions of the loan, including the loan amount, interest rate, repayment period, and other relevant information. When it is signed, both parties must follow its terms and conditions.

Whereas, an acknowledgement of debt is a document that confirms the existence of a debt between the parties. It states the amount owed and the repayment date, but it does not include the detailed terms of the loan.

Summarily, the primary difference is that a loan agreement sets out the comprehensive overview and legal obligations of the parties, while an acknowledgement of debt simply confirms the debt amount and the repayment date.

No, it is not mandatory to have a letter acknowledging an outstanding debt. However, it is good practice to have one as it shows a clear intention to repay.

The debtor is the person who owes money.

The creditor is the person to whom the debt is owed.

Before an acknowledgement of debt is used, there must be a pre-existing debt between the debtor and the creditor.

The acknowledgement of debt will typically be used when there has been a failure to make payments according to the initially agreed-upon schedule in the loan agreement. It does not require a specific duration of non-payment before it can be used, but it is often used when the debtor has missed payments and the creditor wants to formalise the acknowledgement of the outstanding amount.

The creditor can invite the debtor to sign an acknowledgement of debt immediately. There is no need to wait for a specific period of time before issuing an acknowledgement of debt.

A letter of acknowledgement of debt can be used by private individuals who owe money to either another private individual or to a commercial entity.

An example of a private individual owing a commercial entity can either be owing money to a commercial lender, or where the individual owes money for goods to a business and it is yet to pay.

It can also be used by a business that owes another business money. For example, if a business borrows money from a lender and is yet to pay, or if the business purchases goods that have not yet been paid for.

The letter can also be sent by a person authorised to act on behalf of the debtor (i.e., the debtor's agent).

The completed letter acknowledging an outstanding debt should be signed and dated by the debtor, or their authorised agent. The person sending the letter should also keep a copy for their records.

No, it is not necessary to notarise an acknowledgement of debt for it to be valid. It only needs to be signed by the debtor to be valid.

Having a witness for the signing of an acknowledgement of debt is not necessary, but can be helpful to enhance the credibility of the document. For example, a witness can confirm that the debtor indeed signed the acknowledgement of debt and that the debtor understands the terms of the new repayment plan.

A valid witness must be at least 18 years old and not related to either of the parties.

The timeframe within which a debtor must pay after signing an acknowledgement of debt is typically outlined in the terms of the acknowledgement of debt document itself. The parties are free to choose a schedule of payment that is convenient for both of them, as there is no legal limitation on this.

If the debtor fails to pay even after signing an acknowledgement of debt, the creditor can begin legal action to recover the debt. A third party can assist in mediating between the creditor and debtor to negotiate and agree on a settlement before pursuing further legal action (e.g. going to court).

A creditor can send a formal demand letter to the debtor. If the debt is over £5000 for individuals or £750 for companies, the creditor can serve a statutory demand and the debtor will have 18 days to contest it or 21 days to pay the debt.

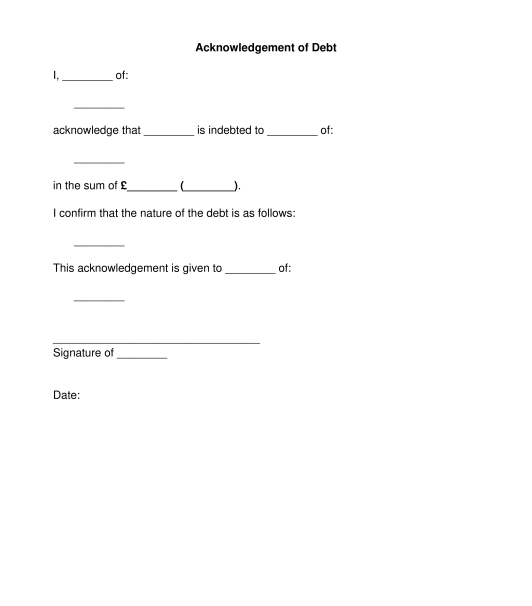

A letter acknowledging an outstanding debt must contain:

The Prescriptions and Limitation (Scotland) Act 1973

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Acknowledgment of Debt - Template - Word & PDF

Country: United Kingdom