10/12/2025

10/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/12/2025

10/12/2025

Word and PDF

Word and PDF

1 page

1 page

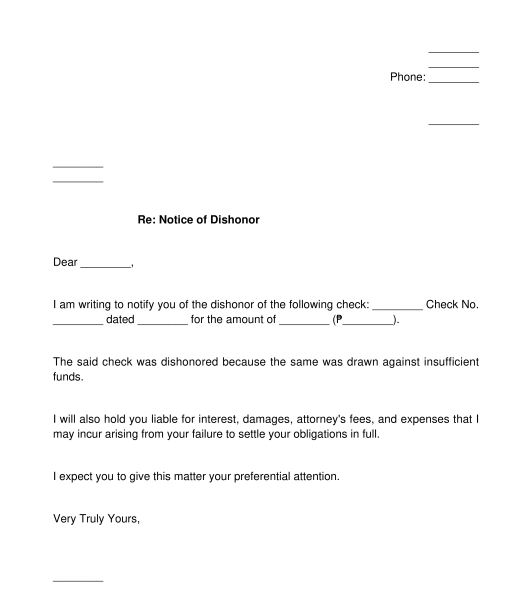

A Notice of Dishonor can be used by a person (called the "payee") to inform another person that wrote the check (called the "drawer") that their check has been dishonored (dishonored means it is not accepted by the bank).

This letter can be used if the check was dishonored for 2 main reasons:

Note that the payee is the person in whose favor the check was written. If the check is payable to "cash" (i.e. the payee named on the check is "cash"), then the payee is the person who holds the check.

While both documents are similar because they involve failure to receive a sum of money, they differ in the following manners:

A Notice of Dishonor is required to be sent to the drawer before a criminal case can be filed against him, by reason of the check's dishonor by a bank due to insufficient funds or a closed account. Without a Notice of Dishonor, no such criminal case can be filed against him, and encashment of the check or payment of the amount under it will not be possible.

Note that the payee and the drawer can always agree to settle the amount in the check between them and not resort to the filing of a criminal case.

Note further that checks are given the same treatment as cash in most transactions which is why writing checks knowing that the account is unfunded or that it has closed is punished by law with imprisonment.

Since a Notice of Dishonor may lead to imprisonment of the drawer of the check, it is important for the payee to make sure that the check has been dishonored by the bank.

The bank will usually inform or notify the payee that the check has been dishonored due to insufficient funds or a closed account resulting in the failure of encashing the check. This notice from the bank should be first obtained before the drawer is informed of the check's dishonor through a Notice of Dishonor.

Once completed, at least two original copies should be printed, then the notice of dishonor should be sent either by registered mail or by personal service.

If it will be sent via registered mail, both original copies of the letter should be signed by the payee, one original copy should be kept by him and the other should be sent to the drawer by registered mail. After sending, the registry receipt or mail receipt in relation to the mailing of the second original copy must be kept by the payee.

If the letter will be delivered through personal service, the drawer must acknowledge receipt, legibly sign both original copies of the Notice of Dishonor, and indicate the date of receipt. The drawer should keep one original copy then the other should then be kept by the person who informed the drawer of a dishonored check, so it can be used as proof of receipt of the Notice of Dishonor.

Note that personal service is the better option between the two modes of sending as it can be ensured that the drawer will acknowledge the receipt of the Notice of Dishonor.

Also note that original copies mean those copies of the Notice of Dishonor that are actually signed by the payee, and not merely photocopies.

After receipt of the Notice of Dishonor, the drawer will have 5 days to pay the payee the amount owed under the check.

The following documents should be available in the event that a criminal case can be filed against the drawer by reason of the check's dishonor by a bank due to insufficient funds or a closed account:

Costs for sending the Notice of Dishonor may depend on the method used in sending the letter. The costs for registered mail or courier will be dependent on the distance between the residence of the drawer and the payee. Similarly, if the Notice of Dishonor is sent personally, the travel expenses will be dependent on the distance between the residence of the drawer and the payee.

A Notice of Dishonor contains the following information:

Batas Pambansa 22 and jurisprudence govern Notices of Dishonor. The Bouncing Check Law is violated when the following elements are present:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter?

Notice of Dishonor for Bounced Check - sample template

Country: Philippines