10/23/2025

10/23/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/23/2025

10/23/2025

Word and PDF

Word and PDF

1 page

1 page

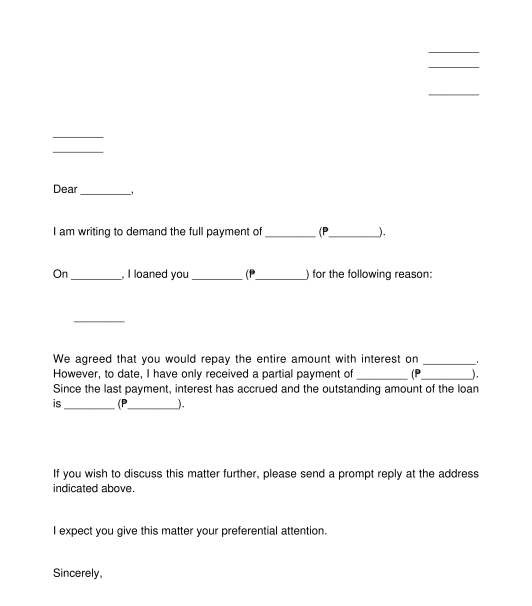

A Monetary Demand Letter can be used to demand the payment of money owed. It is usually used when a person who is owed money has made repeated demands to be paid and has been ignored. In this letter, the person who owes money will be given 5 days to pay the amount owed.

A Monetary Demand Letter can be used for any situation wherein a person is owed money, such as when a person loaned money, sold goods, or provided services, among others.

The Monetary Demand Letter can be used as a written demand before filing a case in a court of law to recover the unpaid money.

The following are the different types of Demand Letters:

If the person who is owed a sum of money wants to bring the issue of non-payment of the person that owes money, to a court of law, such court will require that a written Demand Letter be sent to the person that owes money.

If it will be sent via registered mail, at least two original copies should be printed. Both original copies of the letter should be signed by the sender (the person is owed an amount of money), one original copy should be kept by the sender and the other should be sent to the recipient (the person who owes an amount of money) by registered mail. After sending, the registry receipt or mail receipt in relation to the mailing of the second original copy must be kept by the sender.

If it will be sent via email, the sender must send an email attaching one scanned copy of the letter that is duly signed by the sender or one digital copy that is electronically signed by the sender. An email is a recommended way of sending this letter as the letter is sent instantly and it will enable the parties to keep their records in a convenient manner.

The person who owes money will then have 5 days to pay the amount owed.

Costs for sending the Monetary Demand Letter may depend on the method used by the sender in sending the letter. Email and instant messaging are the most cost-efficient ways of sending a letter as they are generally free, whereas costs for registered mail or courier will be dependent on the distance between the residence of the sender and the recipient.

A Monetary Demand Letter contains the following information:

Although there are no laws that outline the contents of a Monetary Demand Letter, the general laws and procedures for obligations and contracts, such as loans, are governed by the Civil Code of the Philippines and the Rules of Court.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter?

Monetary Demand Letter - sample template - Word and PDF

Country: Philippines