19/10/2025

19/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

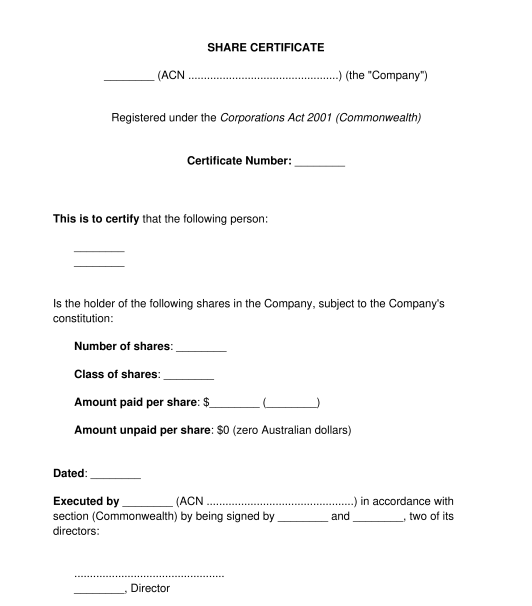

A share certificate is a document which a company issues when a person (or another shareholding entity) acquires shares in the company.

The share certificate will set out all of the pertinent information about the shareholder and about the shares which have been purchased. It will serve as legal proof that the shareholder actually owns the shares in the company.

A share certificate is proof that the shareholder actually owns the shares in the company. So it is used when the shares are actually acquired by the new shareholder.

A Share Sale Agrement is a contract for the sale and purchase of existing shares from a current shareholder to a new shareholder. It is signed before the shares are actually sold. Once the sale takes place, the new shareholder can receive a Share Certificate as proof that they now own the shares.

A Share Subscription Letter is similar to a Share Sale Agreement but it is used when the company is planning to create new shares and provide them to a new shareholder. Again, once the new shareholder receives the shares, they can be provided with a Share Certificate as proof that they now own the shares.

Yes. A share certificate must be issued within two months of allocating the shares.

Before a Share Certificate is issued, the relevant parties should prepare a Share Sale Agreement (if shares are being sold from one shareholder to another) or a Share Subscription Letter (if new shares are being created and provided to the new shareholder).

Once the shares are ready to be provided to the new shareholder, the company should firstly update its register of shareholders. While a Share Certificate provides evidence of ownership of the shares, it can be thought of as a receipt. The Corporations Act confirms that a person becomes a shareholder if/when their name is entered in the company's register of shareholders. Therefore, the register of shareholders is the ultimate record of ownership of the shares.

Once the register of shareholders has been updated, the Share Certificate can be finalised.

A share certificate is issued by the company, so it should be signed by the directors of the company and provided to the relevant shareholder.

Once the document has been prepared, the company is required to update its register of shareholders (also known as a members register) to reflect the current ownership of the shares in the company. The company may then sign the Share Certificate and a copy may be provided to the shareholder who has purchased the shares. A copy may also be kept with the company's records.

Generally, section 1071H of the Corporations Act 2001 (Commonwealth) requires that when a company issues shares, it issues a share certificate within two months.

When a company issues shares, it is required to notify the Australian Securities and Investment Commission within 28 days.

It is not necessary to register a Share Certificate, but, there are a few mandatory steps that need to be taken in connection with the Share Certificate.

Firstly, before the Share Certificate is signed and provided to the relevant shareholder, the company should update its register of shareholders to record the new owner of the shares.

Then, once the Share Certificate has been signed and given to the shareholder, and within 28 days of the issue of shares, the company must notify the Australian Securities and Investment Commission.

A Share Certificate should record:

The Corporations Act 2001 (Commonwealth) applies to company matters in Australia, including the issuing of Share Certificates.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Share Certificate - sample template - Word and PDF

Country: Australia