10/09/2025

10/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/09/2025

10/09/2025

Word and PDF

Word and PDF

1 to 2 pages

1 to 2 pages

This Share Subscription Letter can be used when a new investor wishes to subscribe for shares in a company. It serves a similar function to a Share Subscription Agreement but is simpler and less complex so it may be suitable for smaller companies or basic share subscriptions when a company is in its early stages. The simplicity of the document makes it quick and easy to prepare, and easy to understand, which can help smaller companies to move quickly when bringing on new investors.

While a Share Subscription Agreement usually contains detailed warranties and indemnities from the company, a Share Subscription Letter does not, which means it is up to the investor to conduct any due diligence to make sure they are comfortable with the company and the proposed investment, before they sign the letter.

When companies are trying to grow, issuing new shares is a great way to create that growth, as it allows the company to bring in new investors. It is important that when doing this, the company keeps written records of the shares that have been issued and the investments that have been made. This Share Subscription Letter provides a useful written record which companies can use for this purpose.

Taking the time to prepare a Share Subscription Letter can also help to avoid disagreements in future as it provides a clear record of what the company and the investor are expecting from each other.

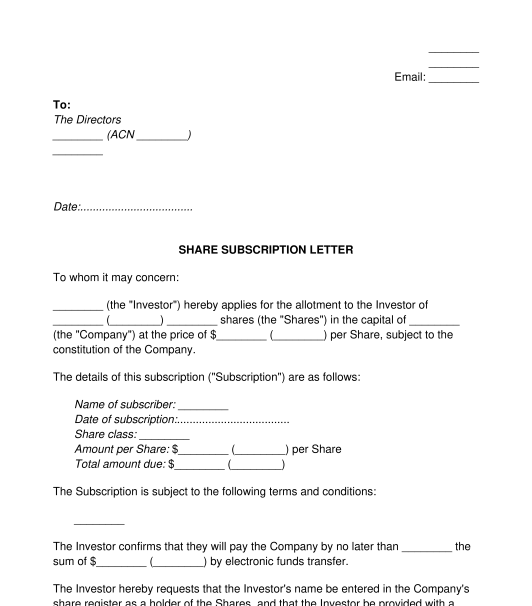

The document confirms that the investor is applying for shares in the company. It confirms how many shares the investor will be getting, what kind of shares they are, the price of the shares, and the total amount of money they are investing in return for those shares.

How to use this document

Check the company's constitution and shareholder agreement to confirm whether any particular process needs to be followed in order to subscribe for shares.

The document may be filled out with the details of the investor (the person or entity that is subscribing for shares in the company), and the details of their investment. Enter the details of the class of shares, price per share, and total investment amount.

Once the document has been prepared, it may be signed by the investor, dated, and provided to the company. Both the company and the investor should keep a copy on file for their own records.

Once the shares have been issued, there may be other mandatory steps for the company to take, such as updating the company's share register and notifying ASIC of the new issue of shares.

Applicable law

The Corporations Act 2001 (Commonwealth) applies to companies in Australia.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Share Subscription Letter - sample template

Country: Australia