10/16/2025

10/16/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.7 - 448 votes

Download a basic template (FREE) Create a customized documentA promissory note, also known as an IOU, is essentially a one-sided document with which a borrower agrees to pay a lender back for money borrowed. Often, promissory notes are used in place of more formal loan agreements when the loan is being made informally between friends or family members. Promissory notes can even sometimes be used between very small businesses. A promissory note's primary function is to serve as written evidence of the amount of the debt and the terms under which it will be repaid.

Though they are both documents used to outline the details of a loan, a loan agreement and a promissory note are different in several respects. The main difference is that a loan agreement is much more detailed and complex. It includes extensive provisions about when and how the borrower will repay the loan and what sorts of penalties will be incurred if the borrower does not follow through with repayment. Loan agreements are usually used when large sums of money are involved, such as student loans, mortgages, car loans, and business loans.

Promissory notes are much simpler documents. Unlike a loan agreement, which is binding on both the lender and the borrower, promissory notes are a one-sided document where the borrower agrees to repay the lender. Promissory notes are typically used for more informal arrangements between friends and family members or very small businesses.

For more information about which document to use in which circumstances, please refer to the guide What is the Difference Between a Promissory Note and Loan Agreement.

No, it is not mandatory to use a promissory note when one party lends another money. Many times, friends or family members lend each other money informally without keeping a written record. However, it can be beneficial to use a promissory note because having written proof of the loan makes it much more likely to be repaid.

In the context of a promissory note, interest is the monetary charge for the privilege of borrowing money, typically expressed as an annual percentage rate. An interest rate is a pre-determined percentage of the total loan that accumulates over time and is added onto the original loan amount at the end of each year.

The party entering into the promissory note is known as the borrower. Both individuals and businesses may enter into a promissory note. For individuals entering into promissory notes, they must be of legal age to enter into a contract, 18 years of age or older in most states. They must also be mentally competent to enter into a contract. Business entities entering into a promissory note must have the legal authority to do so, usually outlined in the business' governing documents, such as bylaws or operating agreement.

Though the lender may charge the borrower interest, most states have laws regarding the maximum amount of interest that they may charge. These laws are known as usury laws and vary from state to state.

Once all the provisions of the note have been filled out, the parties should print out the document and the borrower should sign and date it. Since the note is only binding on the borrower, they are the only one who must sign it. Each party should save a copy of the note for their records in case of future misunderstanding or dispute.

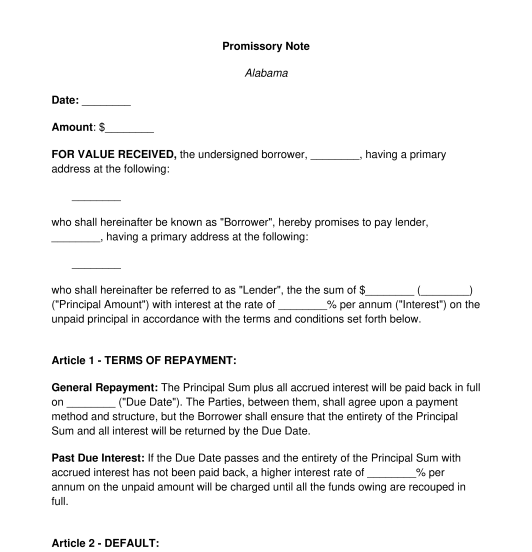

A valid promissory note must contain at least the following mandatory sections:

Promissory notes are a matter of both state and federal law. Promissory notes are primarily controlled by Article III of the Uniform Commercial Code (the "UCC"). The UCC governs commercial transactions, and article III specifically applies to promissory notes and loan agreements.

The Truth in Lending Act ("TILA") is a federal law that requires lenders to provide borrowers clear and thorough information about the terms of the loan into which they are entering, including the interest rate and any fees associated with the loan.

State-specific usury laws dictate the maximum amount of interest that may be charged on a loan. Statutes of frauds, also state-specific, require that loans over a certain amount be memorialized in writing to be enforceable.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Promissory Note - FREE - Template - Word & PDF

Country: United States