09/14/2025

09/14/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 1,359 votes

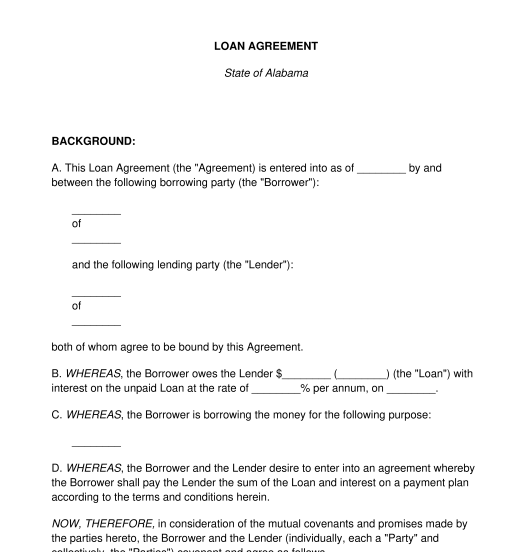

Download a basic template (FREE) Create a customized documentA loan agreement is a contract between a lender and a borrower where the lender agrees to lend the borrower money and the borrower agrees to pay the lender back according to a schedule as described in the agreement. Its primary function is to serve as written evidence of the amount of the debt and the terms under which it will be repaid.

Though they are both documents used to outline the details of a loan, a loan agreement and a promissory note are different in several respects. The main difference is that a loan agreement is much more detailed and complex. It includes extensive provisions about when and how the borrower will repay the loan and what sorts of penalties will be incurred if the borrower does not follow through with repayment. Loan agreements are usually used when large sums of money are involved, such as student loans, mortgages, car loans, and business loans.

Promissory notes are much simpler documents that are more akin to an IOU. Unlike a loan agreement, which is binding on both the lender and the borrower, promissory notes are a one-sided document where the borrower agrees to repay the lender. Promissory notes are typically used for more informal arrangements between friends and family members or very small businesses.

These two documents are related but are used at different points in the loan process and involves different parties.

The loan agreement sets out the initial terms of the money being lent and involves just the borrower and the lender. The guaranty agreement is an optional additional agreement that is added to the loan agreement. It involves a third party, known as the guarantor, agreeing to pay back the loan if the person who takes out the loan defaults or does not pay. In the guaranty agreement, only one party is signing the actual document, the guarantor, but the agreement is made among the lender, who is lending the money, the borrower, who is borrowing the money, and the guarantor who is committing to repay the loan if the borrower cannot.

No, it is not absolutely mandatory for a loan agreement to be used when one party loans money to another in most states. However, since loan agreements usually involve large sums of money, such as car loans, mortgages, or business loans, it is highly recommended that the party use a written loan agreement. Using a written agreement means that both parties understand exactly what they agree to and are able to refer to their written agreement later on in case of future disagreement or dispute.

There are some states which have laws saying that loans over a certain amount must be in writing. Refer to state law to find out more about these requirements.

In the context of a loan, interest is the monetary charge for the privilege of borrowing money, typically expressed as an annual percentage rate. An interest rate is a pre-determined percentage of the total loan that accumulates over time and is added onto the original loan amount at the end of each year. It is not mandatory to apply interest to a loan.

A balloon payment is a large sum of money that the borrower must pay at the end of the term of the loan to decrease their scheduled installment payments over the life of the loan. For example, if a borrower wanted to borrow $10,000 at 8% interest and repay the loan over five years, but the standard monthly payments of $202.76 were too high, the borrower and lender could agree to a balloon payment. The borrower could pay $175 each month and then, when the five years had passed, make a final balloon payment of the remaining $2,000. The payment makes up for the decreased monthly payments and may be more manageable for the borrower.

Collateral is the use of personal property or real estate to secure a loan. If a borrower is using collateral, they agree to give up ownership or title of the property to the lender in the event that they are unable to pay back the loan. Unlike a guaranty, which involves a third party agreeing to repay a loan, collateral involves the borrower using their own property to secure the loan.

An acceleration clause is a term in a loan agreement that requires the borrower pay off the entirety of the loan immediately if certain conditions are not met. Most commonly, this would come into play if a borrower stopped making payments on the loan using the agreed upon schedule.

Though the lender may charge the borrower interest, most states have laws regarding the maximum amount of interest that they may charge. These laws are known as usury laws and vary from state to state.

The duration of a loan can vary widely depending on the circumstances. For example, a small loan of several hundred dollars could be repaid over the course of several months. Larger loans, such as mortgages or student loans, are often paid off over the course of decades. There is no limit to the duration of a loan agreement.

Once all the provisions of the contract have been filled out, both the borrower and the lender should print out and sign the document, each saving a copy for their records in case of future misunderstanding or dispute. The document does not need to be notarized or witnessed to be legally binding. If the loan is being secured by real estate used as collateral, the borrower should be sure to properly register this collateral according to the laws of the state in which it is located.

A valid loan agreement must contain at least the following mandatory sections:

Loan agreements are a matter of both state and federal law. Loan agreements are primarily controlled by Article III of the Uniform Commercial Code (the "UCC"). The UCC governs commercial transactions and article III specifically applies to loan agreements, specifically those that involve the use of collateral.

The Truth in Lending Act ("TILA") is a federal law that requires lenders to provide borrowers clear and thorough information about the terms of the loan into which they are entering, including the interest rate and any fees associated with the loan.

State-specific usury laws dictate the maximum amount of interest that may be charged on a loan. Statutes of frauds, also state-specific, require that loans over a certain amount be memorialized in writing to be enforceable.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Loan Agreement - FREE - Sample, template - Word and PDF

Country: United States