10/09/2025

10/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/09/2025

10/09/2025

Word and PDF

Word and PDF

1 page

1 page

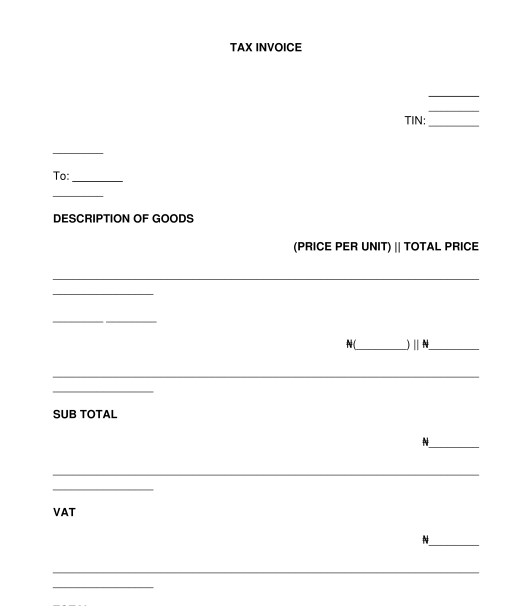

The Invoice is a bill of charges sent by an individual or business relating to a business transaction, which indicates the specific details of the goods or services sold, the number of goods sold, and applicable VAT. An invoice is a vital aspect of the audit trail of the vendor's business and failure to issue an invoice is a violation of the law.

An invoice is used by a vendor or service provider when goods or services have been sold to clients or customers on credit. It also serves as evidence in a monetary demand claim to illustrate that goods or services were provided, and payment was demanded.

In this document, the sender of the invoice is required to provide the names and address of the sender and recipient, the invoice or reference number, the date the invoice was sent, a clear description of the goods or services, the quantities of goods sold, price of the goods or services and payment method. This document can be attached to a Cover Letter which is also available for download.

This document should be used by individuals or businesses to demand payment for goods sold or services rendered. It can also be used by service providers or independent contractors who are required to send their invoices before receiving payment for services rendered.

After completing this document, the sender is required to sign the document and deliver it to the recipient, who will acknowledge receipt for record purposes.

If upon the receipt of the invoice, the recipient fails to make a payment, the sender can send a letter demanding payment for good(s) sold or service(s) rendered.

The Value Added Tax Act regulates the content and form of an invoice, which must be strictly adhered to by vendors and suppliers of goods and services. Also, the Finance Act provides a standard VAT rate of 7.5% chargeable on all taxable goods and services. Additionally, the general rules of contract apply to this document.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Obtain a Tax Identification Number (TIN)

Invoice - FREE - sample template online - Word and PDF

Country: Nigeria