30/04/2025

30/04/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

30/04/2025

30/04/2025

Word and PDF

Word and PDF

4 to 6 pages

4 to 6 pages

A donation agreement is a contract between a donor (donation giver) and a donee (donation receiver). The donor can be any entity. However, the donee must be a non-profit organization or a charity. Typically, a non-profit will donate to another non-profit if they have similar goals and visions.

Donations can take many forms. They can include one-time cash payments, recurring cash payments, real estate, personal property, services, and more.

The difference between this donation agreement and a grant agreement is that the grant is typically for a very specific purpose. On the other hand, the donee can utilize the donation for more general purposes related to its objectives. In other words, there's more flexibility in how the donation can be used.

For example, suppose an individual wants to donate money to an animal shelter. That individual can donate the money to help shelter and care for the animals. On the other hand, suppose a charitable foundation wants to give a grant to other educational foundations. The charitable foundation can create a grant program targeting educational foundations who can apply for the grant money.

A non-profit organization can become a registered charity if they meet the requirements. To meet the requirements, the organization must apply to the Canada Revenue Agency (CRA) and fall within the categories of charitable purpose. For example, community benefits such as crisis counselling, poverty relief, and more. Once registered, the CRA will designate the registered charity as either:

Unlike a for-profit corporation, a not-for-profit organization doesn't operate with a view to profit or gain.

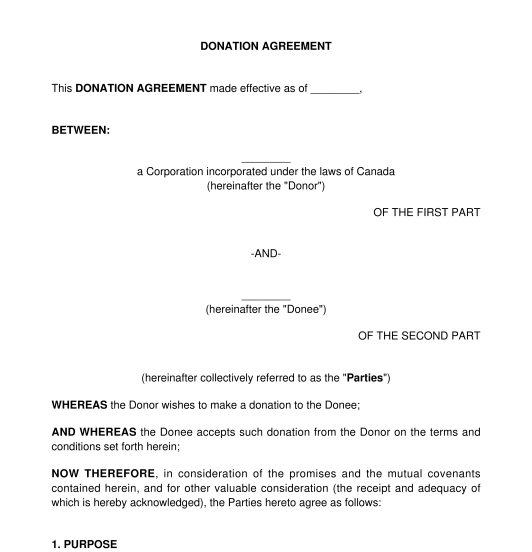

This document can be used when a donation is being made to a non-profit organization or a registered charity. The document includes basic information such as the total amount of the donation, the terms of payment, and the purpose of the donation.

Once completed, the parties must print and sign the document (or sign electronically). The parties must keep a copy of the signed agreement for their records.

Specific laws will apply depending on the non-profit organization's business structure. For example, if the non-profit were incorporated under the laws of Ontario, the Not-for-Profit Corporations Act, 2010, S.O. 2010, c. 15 applies. If the corporation were federally incorporated, the non-profit would be governed by the Canada Not-for-profit Corporations Act (S.C. 2009, c. 23).

Also, non-profits, like any other business, will be subject to income tax laws under the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)). For example, a registered charity receiving funds must provide an official donation receipt consistent with the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Donation Agreement - Sample, template - Word & PDF

Country: Canada (English)