27/09/2025

27/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

27/09/2025

27/09/2025

Word and PDF

Word and PDF

7 to 10 pages

7 to 10 pages

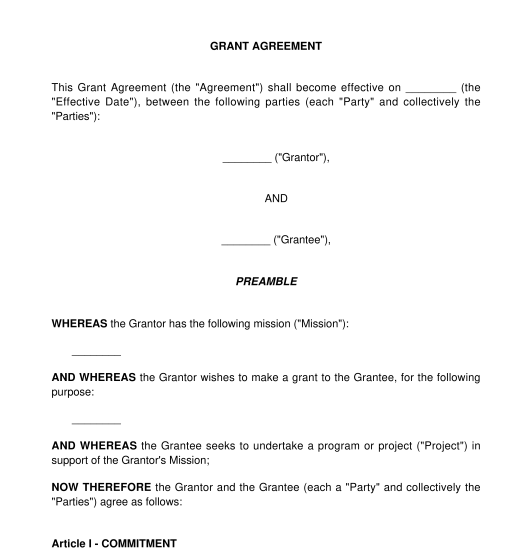

A Grant Agreement is a contract between a grantor and a grantee (or donor and donee). The grantor is the party giving the grant by donating funds. And the grantee is the party receiving the funds. The purpose of the Grant Agreement is to specify how the donation of money or other resources will be spent or allocated to projects. The grant is normally given by a person whose values align with the non-profit's vision.

Both a donation and a grant involve transferring funds or other resources. The difference between a donation agreement and a grant agreement is that the grant is typically for a very specific purpose. On the other hand, the donee can utilize the donation for more general purposes related to its objectives. In other words, there's more flexibility in how the donation can be used.

For example, suppose an individual wants to donate money to an animal shelter. That individual can donate the money to help the shelter with business operations, without a specific purpose. On the other hand, suppose a charitable foundation wants to give a grant to other educational foundations. The charitable foundation can create a grant program targeting educational foundations who can apply for the grant money.

This document requires basic information about the grant, such as the total amount of the grant, the terms of payment, and the purpose of the grant. Also, it requires details about the identity of the grantor and grantee, as well as the grantor's mission.

In short, a Grant Agreement for Non-Profit Organizations should contain the following:

The grantor can be any individual, a non-profit organization, or a charity. The grantee must be a non-profit organization or a charity. Normally, a non-profit will donate to another non-profit if they have similar goals and visions.

A non-profit organization can be structured as either:

Also, the non-profit organization can become a registered charity if they meet the requirements. To meet the requirements, the organization must apply to the Canada Revenue Agency (CRA), and it must fall within the categories of a charitable purpose. For example, community benefits such as crisis counselling, poverty relief, and more. Once registered, the CRA will designate the registered charity as either:

To be exempt from tax, the non-profit organization must be created for purposes other than profit.

Unlike a for-profit corporation, a not-for-profit organization doesn't operate with a view to profit or gain.

Once this document is completed, it must be signed by each party, either electronically or physically. Each party should then keep a copy and upload it to their personal computer for their records. After the document is signed, the grantor can give the grant funds to the grantee.

Grant Agreements are not subject to specific legislation. However, the laws governing contracts apply.

Specific laws will apply depending on the non-profit organization's business structure. The following pieces of legislation apply to incorporated not-for-profit organizations:

Also, non-profits, like any other business, will be subject to income tax laws under the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Grant Agreement for Non-Profit Organizations - Template

Country: Canada (English)