29/12/2025

29/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

29/12/2025

29/12/2025

Word and PDF

Word and PDF

1 page

1 page

An Acknowledgement of Debt can be used to acknowledge any outstanding debt. It acts as a signed letter confirming a debt and promising repayment, and is provided by the debtor (i.e. the person who owes the debt) to the creditor (i.e. the person to whom the debt is owed).

An Acknowledgement of Debt document may also have the effect of extending the time limit or "limitation period" for taking court action to recover the relevant debt. In Australia, a limitation period is the maximum time period in which a creditor can take legal action to recover a debt (usually 6 years). However, if a debt is acknowledged within this time, then the limitation period might be extended.

A Loan Agreement sets out all of the terms of a loan, whereas an Acknowledgement of Debt is a simple letter confirming that one party owes money to the other party. It does not usually deal with loan terms such as repayment dates or interest rates. It is usually used to acknowledge an existing debt.

A Loan Agreement generally includes much more detail than an Acknowledgement of Debt does, and is prepared before any money is actually provided to the borrower by the lender.

No, it is not mandatory to have an Acknowledgement of Debt. However, if the creditor ever needs to prove that the debtor actually owes the debt to them, then the creditor may struggle to do this without some kind of written evidence of the debt.

The main parties in an Acknowledgement of Debt are the debtor and the creditor.

The debtor is the party that owes the debt. The creditor is the party to whom the debt is owed. For instance, if John borrowed $2,000 from Freya, Freya would be the creditor and John the debtor. In such cases Freya may wish to obtain an acknowledgment of debt from John.

Once an Acknowledgement of Debt is ready it should be signed and dated by the person in debt, and provided to the creditor.

The creditor should keep the original safe, but both parties may wish to have copies so that all parties can be clear about the details of the debt.

If the debtor does not pay the debt when due, then the creditor may send a Payment Reminder.

If the debtor ignores the payment reminder, then the creditor may send a Letter of Demand.

After that, if the debtor is still not paying the debt, the creditor can consider taking other action such as engaging a debt collector or commencing legal action.

An Acknowledgement of Debt should include:

Loans are generally subject to the broad principles of contract law in Australia.

Each state and territory of Australia has a Limitation Act which may be relevant to the acknowledgement of a debt.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

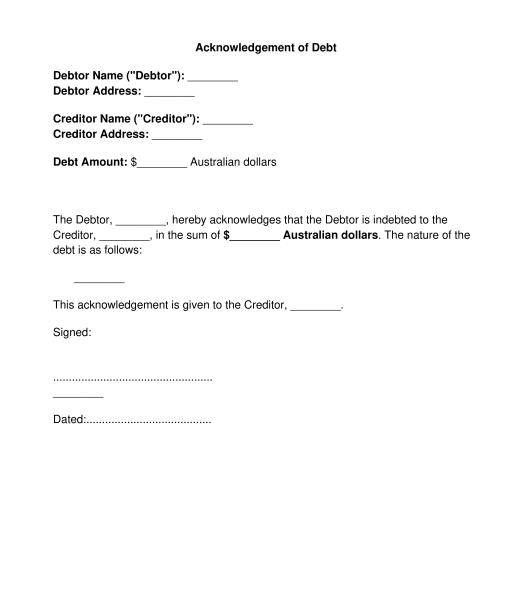

Acknowledgement of Debt - sample template

Country: Australia