31/12/2025

31/12/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

A Payment Reminder can be sent to a person or organisation that has failed to make a required payment. In many cases, the letter may be used by service providers who have invoiced a client, but have not received payment from the client.

A Payment Reminder provides a friendly yet professional reminder that a payment has not been received. It is designed to be one of the first things that businesses use if a payment has not been received. In many cases, businesses find that the failure to pay is simply an oversight, and a gentle reminder such as this is enough to prompt their clients or customers to pay.

A Letter of Demand is a more serious message regarding an overdue payment, threatening legal action if the bill is not paid. Many businesses choose to use a Payment Reminder first, and then if the client still does not pay, then they move on to the Letter of Demand.

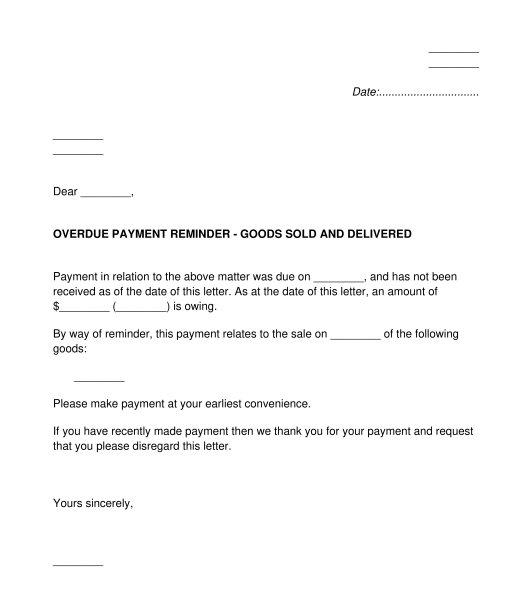

This Payment Reminder states how much money is owed, what it relates to, and when the payment must be made. It presents a polite and professional tone, so that client relationships do not need to suffer as a result of this request for payment.

No, but many service providers find that a Payment Reminder helps them get paid when clients or customers are overdue on their bill.

Before finalising the letter, it is a good idea to check who the letter should be sent to. In some cases, a service provider might have been hired by a company, but all of their dealings might have been with an employee of the company. If this occurs, then the letter may need to be addressed to the company itself, or to the person that owns the company, rather than to the employee.

Once the letter has been finalised, it can be sent (together with any relevant attachments) to the other party.

In order to prove that the letter was sent, it may be helpful to send it by registered post, or by email with a read receipt.

Make note of the new due date for payment. If payment is not received by that date, then the Claimant may consider sending a Letter of Demand or taking other action to pursue the debt, such as commencing legal action.

It is not mandatory to attach anything to the Payment Reminder, although it can be helpful to attach any evidence of the debt. For example, many service providers choose to attach a copy of the original invoice or job proposal, even if they have previously been provided to the debtor.

A Payment Reminder should contain:

Any organisation that is involved in pursuing a debt has various legal obligations. These include obligations to avoid physical force, to avoid unreasonably harassing the debtor, and to avoid providing misleading information about the nature of the debt. Further information is available from the website of the Australian Competition and Consumer Commission.

If the money being claimed relates to the provision of goods or services, or some other agreement between the parties, then general principles of contract law, as provided by the common law, will apply.

If the Claimant provides goods or services to the public directly (rather than to a company) then the Australian Consumer Law may also apply.

If payment is not received after this letter has been provided, and legal proceedings are ultimately commenced, then various other legislation in the relevant state or territory may also be relevant. For example, legislation in relation to the relevant Supreme Court, County Court, District Court, Magistrates Court or Small Claims Tribunal may apply. If the letter is used in court as evidence, then legislation in relation to rules of evidence in the relevant state or territory may also apply.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Payment Reminder - sample template - Word and PDF

Country: Australia