12/31/2024

12/31/2024

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.9 - 107 votes

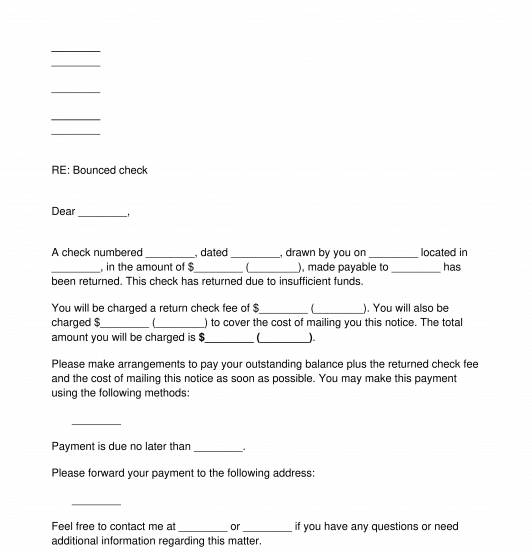

Download a basic template (FREE) Create a customized documentThis Returned Check Notice can be used to inform the writer of a check that the check was returned and that they must make arrangements to make a replacement payment to the person owed money. Using a Returned Check Notice lets the check writer know that their bank has failed to make payment on the check and that they still owe money. Further, the Notice also lets the check writer know whether or not they will be liable for returned check fees (also known as service charges) and/or the cost of mailing the notice by certified mail. Often, a simple notice is enough to get a check writer to replace the money they owe. However, if the check writer fails to make a replacement payment in a timely manner, the person owed money will have a paper trail that shows the check writer was informed of the issue.

How to use this document

This document includes all of the necessary information to identify both parties, including their names and addresses, as well as the particulars of the returned check itself, such as the check number, the financial institution that it was drawn upon, and the reason the check was returned. The person owed money can also specify whether they will be charging the check writer a returned check fee or the cost of mailing this notice, and, if so, the dollar amounts of each of these charges. Finally, the person owed money can outline when the replacement payment is due and what forms of payment they will accept from the check writer.

Once the Notice is completed, the person owed money should send a copy of the notice to the check writer via certified mail. By sending a letter through certified mail, the person who is owed money will have a record of when and where the Notice was received by the check writer. This information could be relevant in case of future dispute or litigation. The person owed money should retain a copy of the Notice for their own records.

Applicable law

The laws around fees, fines, and penalties, both civil and criminal, for returned checks vary from state to state. While there are differences among how bad checks are viewed and the remedies available to persons owed money against check writers, all state laws dictate that the writer of a check who writes said check knowing there is insufficient funds or credit behind the check may be guilty of a crime and may be subject to civil penalties. In the majority of states the crime is treated as a misdemeanor. In states that make a distinction regarding a felony or misdemeanor, the amount of the check usually determines if the crime is a misdemeanor or a felony. In several states, the law provides for fines and or imprisonment but does not specify if the crime is misdemeanor or felony. Some states limit the amount a check writer can be charged for a returned check fee.

If a returned check was written in California and returned due to insufficient funds or a stop payment order requested by the check writer, then the person owed money must send both a notice letter and a separate California-specific notice under California Civil Code Sec. 1719 (included in this document) in order to preserve the right to sue the check writer for damages if they do not make a replacement payment in a timely manner.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Returned Check Notice - FREE - Template - Word and PDF

Country: United States