09/08/2025

09/08/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.7 - 54 votes

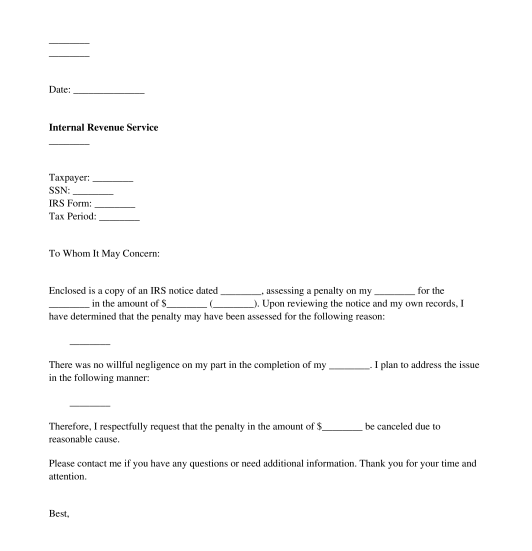

Download a basic template (FREE) Create a customized documentAn IRS Penalty Response letter is a document used to file a request with the IRS that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust or too high be reduced. This letter helps a taxpayer argue their case for why they believe a reduction in the amount of a penalty or a total cancelation of the penalty is justified.

How to use this document

This document includes all of the information necessary for a taxpayer to request that their tax penalty be reduced. The letter includes important identifying information, such as the taxpayer's name, address, and social security number or employer ID number. The letter also includes information that will help the IRS identify the source of the penalty and the reasons why it should be reduced. The letter specifies the tax form that incurred the penalty, a copy of which is generally included with this letter to expedite the IRS review process. The taxpayer is able to explain why they believe the penalty was incurred and the actions they are taking to correct the error which would lead to a justified reduction in the penalty amount. Finally, the taxpayer is able to specify what action they would like the IRS to take regarding the penalty. Most commonly, the IRS will grant a reduction in the penalty. However, depending on the circumstances and what the Requester has done to rectify the situation, the IRS may grant a complete cancellation of the penalty.

Once this letter is completed, it can be sent via certified mail, along with copies of any supporting documents, to the appropriate IRS office. Using certified mail gives the sender receipt that the letter was sent and received, in case of future dispute.

Applicable law

Depending on whether federal, state, or city taxes are the subject of this letter, taxes are governed by laws on multiple levels of government, from federal to local. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. These taxes collected by federal, state, and municipal governments. Therefore, a penalty could be the result of taxes filed with any of these entities.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

IRS Penalty Response Letter - FREE - Sample, template

Country: United States