01/08/2025

01/08/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

01/08/2025

01/08/2025

Word and PDF

Word and PDF

1 page

1 page

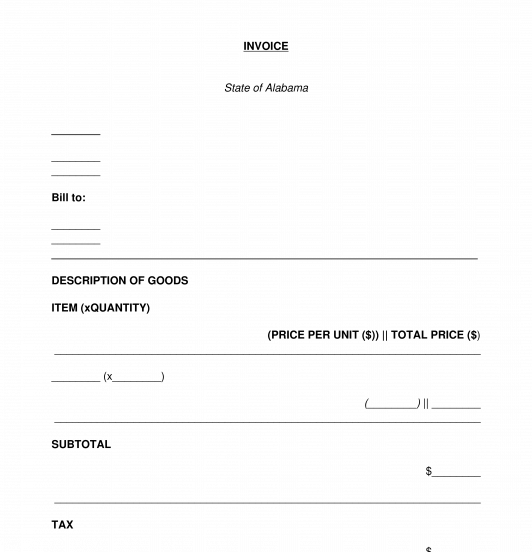

An Invoice is a document used by a buyer and a seller as a receipt for a sale. Once a sale is made, the seller will issue the invoice to the buyer so they can then be paid for the goods or services they provided. The invoice acts as a formal request to the buyer for payment. For a buyer receiving goods or services, it is important for them to have an invoice to save for their tax records and manage and track their cash flow. By using an invoice, both parties can be sure that there is proof of the transaction and a paper trail to refer to in case of a future dispute. An invoice is a key document in any business to make sure everything is covered and documented.

Though similar to a Purchase Order, the primary difference between a Purchase Order and an Invoice is that, generally speaking, a Purchase Order is issued by the buyer while the Invoice is issued by the seller. The buyer sends the Purchase Order to the seller to initiate the purchase. Once the Purchase Order has been fulfilled, the seller issues an Invoice to the buyer. Typically, the Invoice has the Purchase Order number on it to make it easier for the buyer to verify that the product being invoiced matches with the specifications and prices outlined in the original order.

How to use this document

Most purchases are unique but no matter what is being purchased, this invoice includes the common elements and allows for customization for specific purposes. All invoices include the price of each good or service and the amount sold in the case of goods. The invoice also includes a description of the goods or services purchased, applicable taxes, names, dates, and/or contact information involved with the transaction. The invoice also has the option to include a personal thank you message, as well as any relevant payment instructions, such as bank account details.

Once the invoice has been prepared, the seller should send the invoice to the buyer via certified mail or email so that there is a record of the buyer having received the document. The seller should be sure to keep a copy of the invoice for their own records.

Applicable law

Invoices in the United States are generally subject to specific state laws, which cover general contract principles like formation and mutual understanding. State laws also cover commercial transactions and business. They govern which goods and services are subject to sales tax and how much sales tax should be paid. Individual state laws should be checked for anything relating to the sale of goods or the interpretation of the invoice in case of a dispute.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Invoice - FREE - Template, online sample - Word and PDF

Country: United States