01/21/2025

01/21/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

01/21/2025

01/21/2025

Word and PDF

Word and PDF

3 to 4 pages

3 to 4 pages

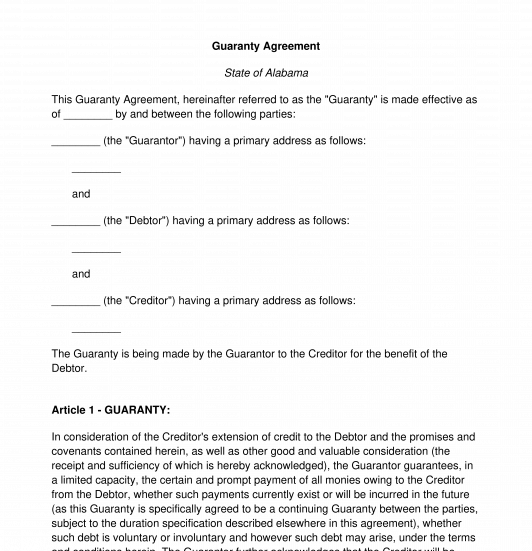

A Guaranty Agreement is an agreement whereby loan or a debt of an individual is "guaranteed" by someone else. In other words, the party "guaranteeing" the loan or debt is agreeing to pay the amount owed if the person taking out the loan or debt defaults, or doesn't pay. In a Guaranty Agreement, only one party is signing the actual document, the guarantor, but the agreement is made among three parties: the creditor, who is extending credit, the debtor, who is taking out the debt or loan, and the guarantor, who is the party guaranteeing the money.

Guaranty Agreements are often quite simple and only need to contain the basic information between the parties: their identities, their contact information, what debt is being guaranteed and the additional terms surrounding that debt.

How to use this document

This document can be used by any of the three relevant parties looking to get their Guaranty Agreement down on paper. A creditor can use this Guaranty Agreement to outline the terms for a line of credit being extended to a debtor with a guarantor, or either the debtor or guarantor can use it to offer a written agreement to a creditor.

No matter which party is filling out this document, it should be done with care to ensure that the true terms of agreement between the parties have been captured. When it is all filed out, it should be printed and signed by the guarantor. Then, a copy should be made for the debtor and the creditor, as well.

Applicable law

Guaranty Agreements are covered by state-specific laws in each jurisdiction.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guaranty Agreement - FREE - Template - Word & PDF

Country: United States