09/30/2025

09/30/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/30/2025

09/30/2025

Word and PDF

Word and PDF

12 to 16 pages

12 to 16 pages

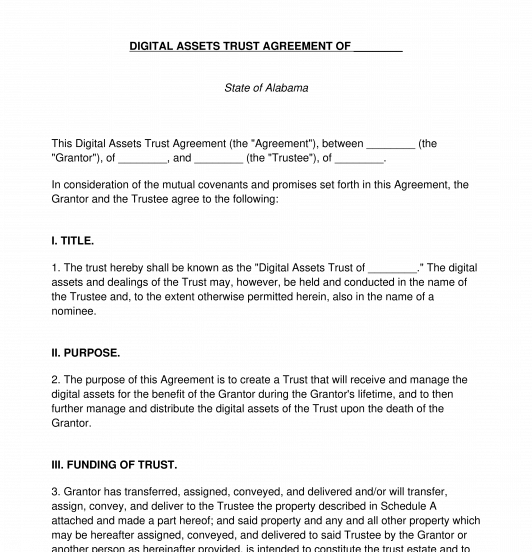

A Digital Assets Trust Agreement is a document created by an individual, known as the Grantor, to hold their digital assets during their lifetime. A digital asset is anything that is created and stored digitally and has value, such as cryptocurrency, photographs, documents, and data. Once the digital assets are put in the Trust, the Trust pays income to the Grantor if the assets make money during the Grantor's life. Once the Grantor dies, an individual assigned in the Trust document, known as the Trustee, is responsible for the distribution of the remaining digital assets in the Trust to heirs named by the Grantor. Most Trusts name the Grantor as the first Trustee to manage the assets of the Trust until the Grantor becomes disabled, would prefer to have another party manage their affairs, or dies. At this time, a new individual, known as the successor Trustee will step in to manage the Trust and make any necessary distributions. The successor Trustee is most often a bank or a third party who is trusted by the Grantor to manage their assets responsibly.

This Digital Assets Trust is used specifically to manage and maintain digital assets. To create a trust used to maintain tangible assets, such as properties, cars, jewelry, or other physical property, a Living Trust Agreement should be used instead.

How to use this document

Use this document to explain how the Grantor's Trust should be managed while they are alive and then distributed among the people they name once they die. There are several major details that the Grantor must include in the Trust Agreement to accomplish this task.

1. Describe the Grantor's Family: The Grantor should note whether they are married and, if so, the name of their spouse, as well as whether they have any children. All children should be included in the family description, even if the Grantor does not plan to leave them anything in the Trust. This way, a Judge can be sure that the Grantor meant to disinherit a child and did not mistakenly overlook them in this Agreement.

2. Appoint a Trustee: The Grantor must appoint a Trustee in the Trust Agreement. The Trustee is in charge of managing the Trust assets, making payments of the Trust income to the Grantor, and making sure that the people the Grantor has named as beneficiaries get the portion of the Trust described by the Grantor after the Grantor's death.

3. Describe the Trust Assets: The Grantor should describe in as much detail as possible the digital assets they plan to transfer into the Trust. This description should include details such as the names and locations of the digital assets and how they can be accessed by the Trustee and Beneficiaries.

4. Name Beneficiaries: One of the most important parts of a Trust is the Grantor naming their beneficiaries. The beneficiaries are the people who will inherit the contents of the Grantor's Trust after the Grantor's death. The Grantor may make specific gifts in their Trust Agreement, naming specific people to inherit specific accounts or digital files. In addition to specific gifts, the Grantor must also name who will inherit the residue, or remainder, of their Trust.

Once the Grantor has completed their Trust Agreement and thoroughly reviewed it to make sure that their wishes are accurately reflected, the Grantor should sign and date the Agreement in front of three witnesses. The witnesses should also sign the Agreement, attesting that the Grantor was of sound mind and had the capacity to make these decisions when they signed the Trust Agreement. The witnesses should all be 18 years old or older. In addition, the Grantor should number and initial the bottom of each page of the Agreement. Finally, the Agreement includes a page for a notary to notarize to add an extra level of precaution.

Once the Trust Agreement has been signed and completed, it should be put somewhere for safekeeping, such as in a home safe or a bank safety deposit box. The Grantor may also give copies of the Agreement to people with whom they are close and that they trust, such as a spouse or their children.

In addition to creating and signing a Digital Assets Trust document, the assets must be transferred into the Trust. A Digital Assets Trust only applies to the assets that are actually transferred into the Trust. Assets can be transferred both at the time of the creation of the Trust and also at later times. Transferring assets into the Digital Assets Trust will need to be coordinated with the company or entity managing the digital account. Each company has its own rules and regulations regarding account transfer and ownership. The Terms of Use provided by each company managing the digital assets should be read to be certain the Trustee and Beneficiaries will be given access and authority to manage the accounts as directed under the Digital Assets Trust.

Applicable law

The creation and interpretation of all Trusts are a matter of both state and federal law. According to federal tax law, this trust is not appropriate for assets (including life insurance proceeds and retirement plans) which exceed the federal estate tax applicable exclusion amount ($5,200,000.00).

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Notarize a Document

Digital Assets Trust Agreement - FREE - Template

Country: United States