10/02/2025

10/02/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/02/2025

10/02/2025

Word and PDF

Word and PDF

9 to 13 pages

9 to 13 pages

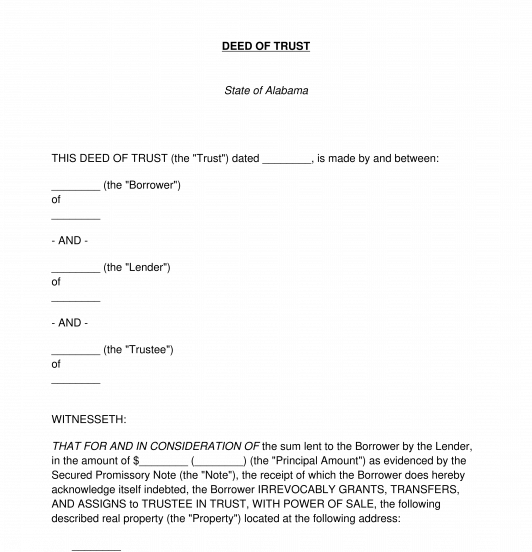

A Deed of Trust is a document used to create a lien on a piece of real property (e.g. a house, plot of land, farm, etc.) to serve as security or collateral for a loan. If the borrower does not repay the loan on time, the lender can use this document to foreclose on and sell the property in order to pay off the outstanding balance of the loan. Unlike a typical deed, it does not immediately transfer to the ownership of real property in the usual sense. Instead, it transfers the property into a trust managed by someone known as the trustee. A Deed of Trust is always used in combination with a Secured Promissory Note which sets out the amount and terms of the loan between the borrower and the lender.

Though a Deed of Trust is similar to a mortgage, the main difference is that the Deed of Trust gives the trustee, a neutral third-party, legal ownership of the property in the trust. This means that the trustee has no control over the property as long as the borrower continues to make loan payments to the lender on time, as well as meeting all of the other terms of the Deed of Trust. However, if the borrower defaults, the trustee has the power to sell the property in order to pay off the loan to the lender without having to involve the courts. This is called a non-judicial foreclosure and is a much swifter and easier process than a judicial foreclosure where the lender must file a lawsuit against the borrower to get their money back.

Though they sound similar, a Deed of Trust is not used to transfer property to a Living Trust. A Living Trust is an agreement created by a person known as a Grantor to hold some portion of their assets during their lifetime. The Trust provides for payment of income to the Grantor and then the distribution of their remaining trust assets once they die. A Quitclaim Deed is a document used to transfer property from the Grantor into the Living Trust. Other than sounding similar, Deeds of Trust and Living Trusts have little else in common and have very different purposes.

How to use this document

This document contains all of the information necessary to place a piece of property in a trust so that it can be used as security or collateral for a loan. Firstly, the Deed should contain all of the information necessary to identify the involved parties, including the borrower, lender, and trustee. The Deed then includes a precise description of the property being transferred. This description includes the address, the legal description, and the parcel ID number of the property. The legal description for the property can be found on previous deeds, tax forms, or at the county's Register of Deeds where deeds are recorded by the county. The parcel ID number, also known as an Assessor's Parcel Number (APN), can be found on past tax statements, a revaluation notice, or a personal property listing form. Finally, the Deed outlines the basic terms of the Secured Promissory Note that is being secured by the property that is being put in the trust to be used as collateral. These terms include details such as how often payments will be made, the amount of the payments, and any applicable interest rates and/or penalties.

Once the Deed of Trust is completed, the borrower must sign and date it in front of a notary and have the document notarized. A notary page is included at the end of the document. After the Deed of Trust is signed and notarized, it needs to be recorded in the county where the property is located. Often a small fee must be paid at the time of filing. The county will keep the original copy of the Deed, but the Parties should keep a copy of the Deed in a safe and secure location for their records and in case of future dispute.

Applicable law

Deeds of Trust are governed by state law. Different states have different requirements for when and how the Deed should be filed. Contact the local county Register of Deeds to get information about which governmental agency should be given the Deed to file and record before being returned to the parties.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Deed of Trust - FREE - Sample, template - Word and PDF

Country: United States