06/11/2025

06/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

06/11/2025

06/11/2025

Word and PDF

Word and PDF

1 page

1 page

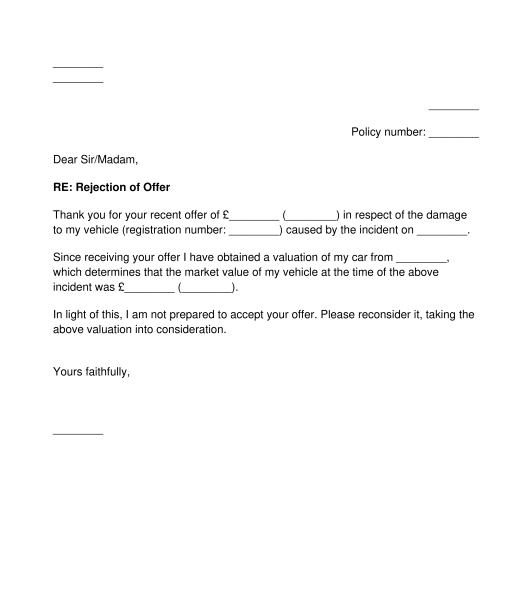

A Letter to Reject a Car Insurer's Offer is a formal letter sent by a policyholder to their insurer informing the insurer of the decision to decline or reject the compensatory offer made by the insurer. For example, if a person gets into a car accident that is not their fault and their insurer makes them an offer to cover the costs of the accident, they can use this letter to reject the car insurer's offer if they find the offer unacceptable.

No, strictly speaking, it is not mandatory to have a Letter to Reject a Car Insurer's Offer. However, it is highly recommended to have one, as it serves as a formal record of the policyholder's decision to reject the offer. Additionally, the letter helps the policyholder more clearly state their reason for rejecting the offer.

Before using a Letter to Reject a Car Insurer's Offer, the insurance company must have first presented the policyholder with an offer. The policyholder should have also carefully considered the offer before deciding to reject the offer.

A Letter to Reject a Car Insurer's Offer can be used by any person or entity that is named as a policyholder on the car insurance. This means that it can be used by private individuals as well as businesses such as sole traders, general partnerships, LLPs, or a company. What matters is that the entity is named as the policyholder for the car insurance on the vehicle involved in the car accident.

Once the Letter to Reject a Car Insurer's Offer is ready, it should be signed by the policyholder who is sending the letter. Then, it should simply be posted or emailed to the car insurer and await their response. The policyholder should keep a copy of the letter for their records.

The following documents can be attached to a Letter to Reject a Car Insurer's Offer:

No, it is not necessary to have a witness for a Letter to Reject a Car Insurer's Offer. This is because it is a letter and not an agreement.

If the car insurer does not respond within 14 days, the policyholder may choose to consider escalating the matter to the financial ombudsman or to a small claims court.

A Letter to Reject a Car Insurer's Offer should contain:

The relationship is subject to the principles of contract and insurance law.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Letter to Reject Car Insurer's Offer - Sample, template

Country: United Kingdom