04/09/2025

04/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

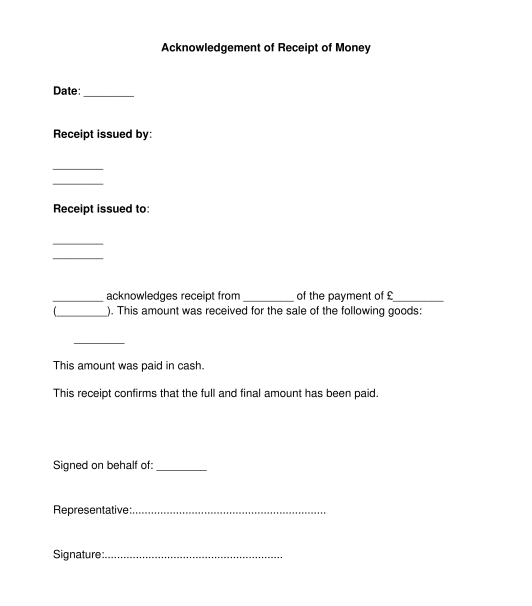

A general receipt is a document used to provide acknowledgement of receiving payment for goods sold or services provided. Additionally, the general receipt provides written proof of a payment made by one party to another. It is important as it serves as evidence of the transaction, which can be crucial in case of disputes regarding payment.

No, it is not mandatory to have or issue a general receipt. However, it is highly recommended and generally accepted as good practice to issue one in commercial transactions.

This is because a general receipt acts as proof of payment, which is crucial for resolving disputes. It also helps maintain accurate financial records, which is essential for budgeting, financial planning, and compliance with tax regulations for businesses. Issuing receipts also builds customer trust by demonstrating professionalism and transparency. Additionally, a receipt offers legal protection by documenting transaction details, making it valuable evidence in case of legal disputes.

The validity of a receipt depends on its intended use and the applicable laws for that particular kind of transaction. For example, in the UK, businesses must keep a record of all expenses and benefits they provide to employees for three years. For personal record-keeping, it's advisable to retain receipts for major purchases, repairs, and services for the item's warranty period or for as long as the item is owned.

The issuer of a receipt is the person who received payment, while the recipient is the person who made the payment.

Once completed, the receipt should be printed and signed by the issuer. The original signed receipt can be given to the recipient, while the party issuing it should keep a copy for their records. In some cases, it may also be good for the recipient to sign the receipt as a confirmation of what is stated in it.

No, it is generally not necessary to register or notarize a receipt. Receipts are typically informal documents used to provide proof of payment and record the details of a transaction. However, it could be beneficial for large transactions, where disputed payments occur.

No, witnesses are not generally required for a receipt, however they can be beneficial in certain high value, or disputed transactions to provide verification. For instance, within a loan between two parties, related documents often require the signatures of witnesses to validate the transaction legally. This ensures that all parties involved are aware of and agree to the terms.

A general receipt must contain:

There are no laws legally requiring the issuance of a receipt, except in relation to charitable donations and rent payments.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

General Receipt - Sample, template - Word & PDF

Country: United Kingdom