26/11/2025

26/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

26/11/2025

26/11/2025

Word and PDF

Word and PDF

1 page

1 page

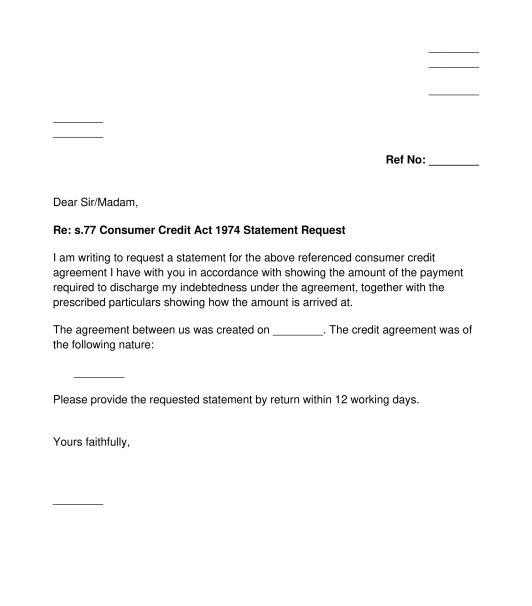

A Consumer Credit Statement of Account Request Letter is a formal letter written to a lender asking for the consumer's statement of account in relation to any consumer credit agreement (or loan agreement) between the parties.

An example of where this letter can be used is when a credit card holder contacts their bank to get the statement account on their credit card.

No, it is not mandatory to have a Consumer Credit Statement of Account Request Letter. However, the consumer (also known as the borrower) can choose to use such a letter as a way of formally exercising their right to access their statement of account. The letter can also be important if the consumer wishes to verify the details of their account for their records.

A Consumer Credit is a loan or credit given to an individual (i.e. a consumer) to be used for personal purposes. This means that the loan must not be used for business or commercial purposes. As such, a loan agreement given to an individual for personal use can also be referred to as a consumer credit agreement. Examples of consumer credit agreement include a credit card from a bank, car finance agreement, store credit agreement, buy now pay later agreement, etc.

Before using a Consumer Credit Statement of Account Request Letter, there should already be a loan agreement in place under which the consumer has been given a loan.

A Consumer Credit Statement of Account Request Letter can be used by a private individual who is a borrower in a loan agreement.

This means it cannot be used by a business or borrower that is a party to a commercial loan.

A Consumer Credit Statement of Account Request Letter can be sent at any time during the loan agreement. This enables the consumer/ borrower to properly manage their debt and make future plans about it.

Once this document is completed, it should be signed and then posted or emailed to the lender. The lender should write back with the requested statement.

No, it is not necessary to have a witness for a Consumer Credit Statement of Account Request Letter. This is because it is not an agreement but just a formal letter addressed to the lender.

Yes, the lender has to acknowledge a Consumer Credit Statement of Account Request Letter within 12 working days, otherwise, it will be breaking the law contained in Section 77 of the Consumer Credit Act 1974 and cannot require any further payment from the borrower until they have provided the requested information.

The Consumer Credit Statement of Account Request Letter should contain:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Country: United Kingdom