09/16/2025

09/16/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/16/2025

09/16/2025

Word and PDF

Word and PDF

3 to 4 pages

3 to 4 pages

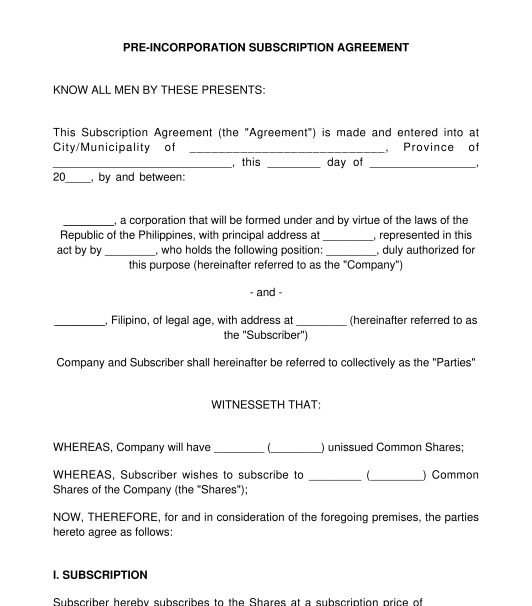

A Subscription Agreement is a document wherein a person (the "Subscriber") agrees to acquire the unissued shares of an existing corporation or a corporation that will be incorporated (the "Company"). However, some also use Subscription Agreements for acquiring shares that will come from an increase in the authorized stock of an existing corporation.

A Subscription Agreement should contain the basic terms and conditions of the acquisition such as the number of shares that will be acquired, the price for the acquisition, and the manner of payment.

A Subscription Agreement is mandatory in case the corporation yet to be formed will issue shares and the subscriber wants to acquire said shares. It is also mandatory if an existing corporation will increase its authorized capital stock. These two are the common situations where the Securities and Exchange Commission will require a Subscription Agreement. The Securities and Exchange Commission website may be checked to determine situations where a Subscription Agreement may be mandatory.

To acquire the shares, the subscriber should pay the price with cash. If the payment will not be in cash but by a property, then the value of such property shall first be determined by the stockholders or the board of directors of the Company and said value shall be subject to the approval of the Securities and Exchange Commission.

A Subscription Agreement contains the following information:

A Subscription Agreement is signed by the subscriber or the person who will acquire the shares and the authorized representative of the corporation who will issue the shares.

The subscriber can be an individual or an organization (i.e. another corporation or partnership). If the subscriber is an organization, then the person who should sign the Subscription Agreement is its authorized representative who must be equipped with a Secretary's Certificate (If the subscriber is a corporation) or a Partners' Certificate (If the subscriber is a partnership).

The Subscription Agreement may last until the subscriber fully pays the price of the shares.

Further, the Subscription Agreement cannot be canceled after a certain period which is usually 6 months (but a different period can be agreed upon by the subscriber and the corporation). During this period, cancellation can only be made if all the other subscribers consent to such cancellation or if the corporation fails to incorporate. After this period, the Subscription Agreement may be canceled freely either by the corporation or by the subscriber.

Note that if the subscriber has failed to pay the amounts stated in the Subscription Agreement within a period of 30 days from the due date stated in the Subscription Agreement, the shares will be called "delinquent shares" and may be sold at a public auction, and the original Subscription Agreement will no longer apply between the delinquent subscriber and the corporation.

Once the Subscription Agreement, at least two original copies of the same must be printed. Once the Subscription Agreement has been printed and the attachments attached if any, the subscriber and the authorized representative of the corporation should review and sign all original copies of the same.

The subscriber and the authorized representative of the corporation may notarize the Subscription Agreement by acknowledging the same before a notary public in which case at least three original copies should be printed. To notarize the document, the subscriber and the authorized representative of the corporation must personally appear before a notary public to acknowledge that they have signed the document freely and voluntarily. They should also present a valid I.D. issued by an official agency bearing their photograph and signature such as a driver's license or a passport, among others.

The notary public will require one original copy of the document. Once notarized, the subscriber and the authorized representative of the corporation should each keep at least one original copy of the notarized document.

Notarization is optional. If notarization is done, it converts the Subscription Agreement from a private document to a public document so that it becomes admissible in court without the need for further proof of its authenticity, meaning, the document will be presumed to be validly written and signed once it is shown to court in case a dispute is brought before it.

However, if the Subscription Agreement will be submitted to the Securities and Exchange Commission due to certain reasons such as incorporation or increase of authorized capital stock, then the Subscription Agreement must be notarized.

If the Subscription Agreement is entered into due to certain reasons such as incorporation or increase of authorized capital stock, then the Subscription Agreement after notarization must be submitted to the Securities and Exchange Commission together with the other documents (i.e. Articles of Incorporation and Treasurer's Affidavit) that may be required by the Securities and Exchange Commission. The Securities and Exchange Commission website may be checked to determine other requirements which may vary depending on the reason for entering into a Subscription Agreement.

Notarization fees for a Subscription Agreement are typically PHP100 to PHP500. However, some notaries public may charge based on the percentage of the value of the shares subscribed, which is usually ay 1%. Further, the Securities and Exchange Commission may require payment of fees when a Subscription Agreement is submitted together with other requirements.

The Revised Corporation Code is the general law that governs Subscriptions Agreements. Several laws, rules and regulations may also affect the Subscription Agreement. Other laws, their rules and regulations, and SEC rules may also affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines, the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the subscription of shares.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Subscription Agreement for Shares of Stock - template

Country: Philippines