10/16/2025

10/16/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/16/2025

10/16/2025

Word and PDF

Word and PDF

4 to 6 pages

4 to 6 pages

A Partnership Dissolution Agreement is a document used by the partners in a partnership when they mutually agree to dissolve the partnership which may either be a general partnership or a limited partnership, and to outline the obligations of the partners in the process of dissolving the partnership.

The dissolution of a partnership is when the partners stop doing or carrying on the business of the partnership together. It usually means that the authority of the partnership to act for the partnership is terminated except as may be necessary to wind up the affairs of the partnership or to complete transactions that were already begun but not yet finished. However, the dissolution of the partnership does not mean that the partnership is terminated since it can still take action in order to wind up or settle the business of the partnership. This means that the partnership will still have to take an inventory of the assets of the partnership, settle and pay its debts, and determine and pay the interest of each partnership. Once this has all been settled, only then is the partnership terminated.

A Partnership Dissolution Agreement is a document used by the partners of a partnership when they mutually agree to dissolve such partnership. On the other hand, an Affidavit of Closure of Business is a document wherein a sworn statement is made establishing that a certain business is closed down.

A Partnership Dissolution Agreement should be used by the partners to close down or dissolve the partnership, after which, a person authorized by the dissolved partnership (i.e. liquidating partner) should sign an Affidavit of Closure of Business to make a sworn statement that the business of the partnership has closed down and submit the same to Bureau of Internal Revenue, Social Security System, Department of Trade and Industry, Department of Labor and Employment, and other relevant government agencies if so required by said government agencies.

The Securities and Exchange Commission will require a Partnership Dissolution Agreement to prove that the partners want the dissolution of the partnership. Further, a Partnership Dissolution Agreement will lay down the terms and conditions as to how the partnership will be dissolved and lay down the expectations of the partners as to how the partnership will end. This will also serve as documentation for what was agreed upon by the partners regarding the dissolution of the partnership.

The following are the different types of partnerships and the applicable Articles of Partnership:

A Partnership Dissolution Agreement contains the following information:

All of the partners should sign the Partnership Dissolution Agreement. One partner that should be noted is the liquidating partner.

The liquidating partner is the one appointed by the partners who will be responsible for determining the extent and whereabouts of all partnership assets and inventory, then the liquidating partner will sell or otherwise dispose of any inventory or assets for the purpose of payment of all the liabilities of the partnership. The liquidating partner is generally the one who will oversee the winding up of the affairs of the partnership.

The Partnership Dissolution Agreement begins the moment it is signed by the partners and ends when the obligations of the partnership to its creditors and other obligations of the partners under the partnership and the Partnership Dissolution Agreement are fully complied with.

Once the document is completed, at least three copies of the document should be printed or in such number as there are partners plus an extra original copy for the notary public. The partners should read the document and sign all original copies of the document.

After this, the document should be notarized. Notarization of the document converts the document from a private document to a public document so that it becomes admissible in court without the need for further proof of its authenticity. To notarize the document, the parties must go to a notary public to acknowledge that they have signed the Partnership Dissolution Agreement freely and voluntarily. They should also present a valid I.D. issued by an official agency bearing their photograph and signature such as a driver's license or a passport, among others.

Once notarized, the partners should each keep at least one original copy of the notarized document, and the last one will be given to the notary public.

The following should be attached to the Partnership Dissolution Agreement:

Yes, notarization of the document converts the document from a private document to a public document so that it becomes admissible in court without the need for further proof of its authenticity, meaning, the document will be presumed to be validly written and signed once it is shown to court in case a dispute is brought before it.

Further, a Partnership Dissolution Agreement will be submitted to the Securities and Exchange Commission as a requirement for the closure of the Partnership. The Securities and Exchange Commission will require that this is notarized.

Yes, a notarized Partnership Dissolution Agreement should be submitted to the Securities and Exchange Commission for the purpose of dissolving the partnership together with the tax clearance of the partnership, the Articles of Partnership, and the Certificate of Registration issued by the Securities and Exchange Commission.

The partners should also publish a notice of the dissolution in a newspaper of general circulation in all the places where the partnership conducted business.

Notarization fees for a Franchise Agreement are typically PHP100 to PHP500. The Securities and Exchange Commission may also require the payment of fees relative to the recording of the dissolution of the partnership.

Partnerships are generally governed and covered by Articles 1767 to 1867 of the Civil Code of the Philippines, as well as the rules and regulations of the Securities and Exchange Commission.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

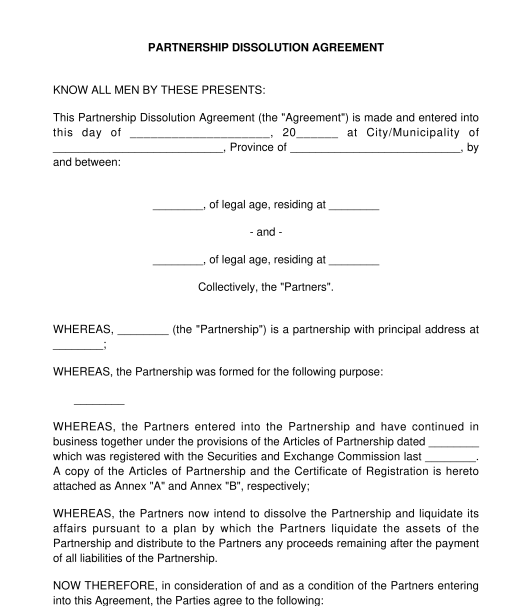

Partnership Dissolution Agreement - sample template

Country: Philippines