10/06/2025

10/06/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/06/2025

10/06/2025

Word and PDF

Word and PDF

2 to 3 pages

2 to 3 pages

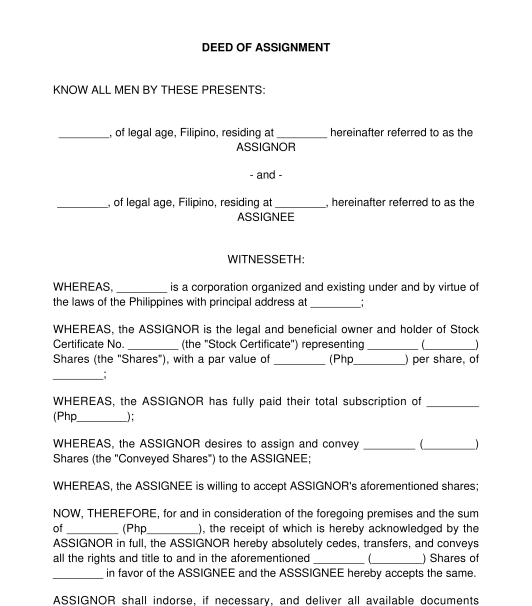

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred.

In order to transfer the shares, the stock certificate should be endorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid.

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document.

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act. Acknowledging a document before a notary public turns the document into a public document. Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax, should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the endorsed stock certificate and the CAR, to the Corporate Secretary so the transfer can be recorded in the books of the corporation.

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern the transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines, the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Deed of Assignment of Stock Subscription - template

Country: Philippines