12/23/2025

12/23/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12/23/2025

12/23/2025

Word and PDF

Word and PDF

4 to 7 pages

4 to 7 pages

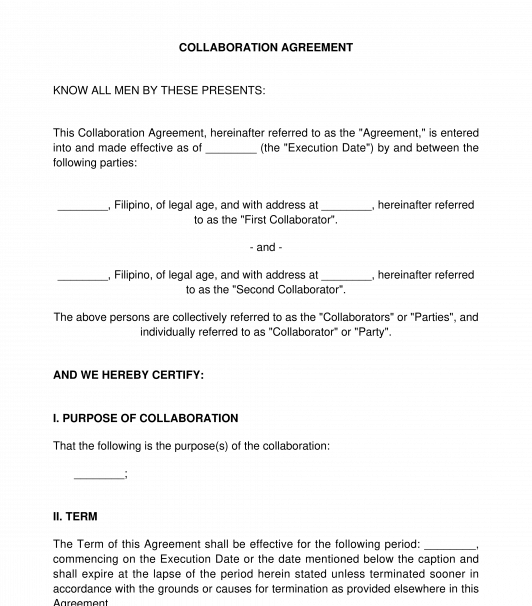

A Collaboration Agreement also known as a Collaboration Contract, is a contract between two or more persons whether individual persons or companies who would like to engage in a specific work, project, or business which are called the Collaborators.

A Collaboration Agreement is limited in scope as compared to a Partnership.

Collaboration Agreement: A collaboration Agreement is just for a single project, work, or business. A business of this kind is one which does not last considerably long as compared to that of a partnership and terminates when a certain period arrives or upon the happening of a certain event. On the other hand;

Partnership: A partnership is much more comprehensive in nature as it means an entity or a company is established by the parties. It aims to establish a business, and earn profits and is expected to last for a longer duration than a Collaboration.

Illustration: Jane Moon and John Sun are both social media influencers, they want to collaborate and create video content for their followers until they reach a certain number of views. In order to properly set forth their agreement to collaborate, they should use a Collaboration Agreement.

The salient provisions of a Collaboration Agreement are the duties and obligations of the parties, as well as the arrangement concerning the profits, losses, and expenses.

This document aims to protect the parties in the Collaboration Agreement and prevent misunderstandings by properly setting forth the details of their upcoming work, business or project.

If the parties want to establish a business, and do not merely want to work on a small project, they may enter into a Partnership, in which case, they should use the document: Articles of Partnership.

The information concerning the collaborators will be included in this document such as their names, citizenship, and addresses. The following will be included in the collaboration agreement:

Upon completing the document, the collaborators should print at least 2 or more copies corresponding to the number of collaborators, and then, they must sign the agreement. After which, they should acknowledge the same before a notary public.

There is no specific law that applies to a Collaboration Agreement, however, depending on the arrangement of the parties, this document may be subject to the provisions of the Civil Code of the Philippines especially the law on Partnerships.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to do after Creating a Contract?

Collaboration Agreement - sample template

Country: Philippines