12/23/2025

12/23/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

12/23/2025

12/23/2025

Word and PDF

Word and PDF

2 to 4 pages

2 to 4 pages

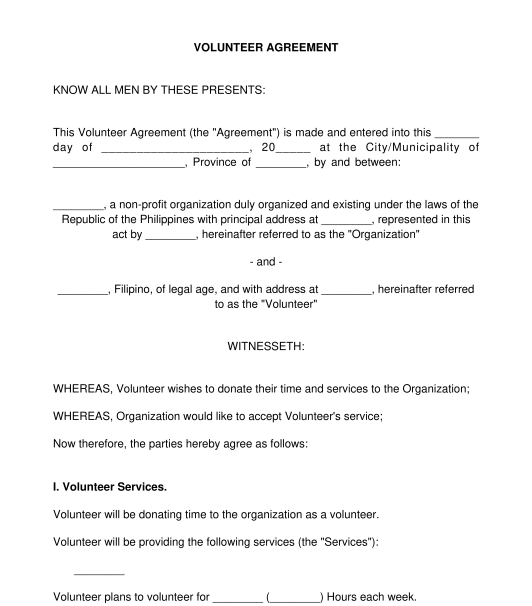

A Volunteer Agreement is a document that can be used by a non-profit organization that wishes to utilize volunteers for their service. Many non-profits that do community service work rely on volunteers as their funding may be limited. Volunteers are not entitled to remuneration, however, some organizations may offer to reimburse volunteers for certain expenses, such as meals, transportations, etc.

Many organizations require volunteers to sign an agreement before they can begin volunteer work in order to inform them of their duties and responsibilities of as a volunteer. A Volunteer Agreement also usually includes a release of liability that is acknowledged by the volunteer.

This document should not be used for hiring an employee. This may only be used for volunteer services.

This document can be used by a non-profit organization who will have volunteers.

The user should enter all the information required to complete the document including the information about the non-profit organization and the duties and responsibilities of the volunteer. This document has the option of filling up the personal information of the volunteer by hand in the event that the document will be completed and signed on-site.

Once completed, the document can be printed and signed by both parties. Each party should keep a copy of the document for their records.

Notarizing the document

Notarizing this document is optional. However, if the parties would want to notarize this document, the document includes an Acknowledgment portion. Notarization of the document converts the document from a private document to a public document so that it becomes admissible in court without need of further proof of its authenticity.

To notarize the document, the parties must print and sign an extra copy (for the notary public) of the document and bring all the copies to a notary public to acknowledge that they have signed the Volunteer Agreement freely and voluntarily. They should also present a valid I.D. issued by an official agency bearing their photograph and signature such as a driver's license or a passport, among others.

Once notarized, the parties should each keep at least one (1) copy of the notarized document and the notary public will also keep one (1) copy for their notarial book.

The laws on contracts and obligations under the Civil Code of the Philippines applies.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What to do after Creating a Contract?

Volunteer Agreement - sample template - Word and PDF

Country: Philippines