10/07/2025

10/07/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/07/2025

10/07/2025

Word and PDF

Word and PDF

1 page

1 page

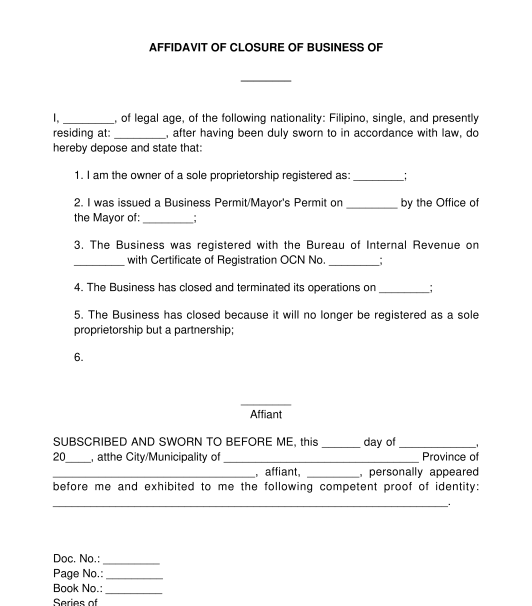

An Affidavit of Closure of Business is used by the owner of a business or its authorized officer (called the "Affiant"), to inform third parties that a business has closed or ceased its operations. It is usually required when canceling business permits or other documents and certificates issued by various government agencies, but it may also be used as a simple but formal notification.

This document can be used to report the closure of a business such as a sole proprietorship, a partnership, a corporation, or a cooperative, and is one of the common requirements of various government agencies to report such closure.

A Partnership Dissolution Agreement is a document used by the partners in a partnership when they all agree to dissolve such the partnership business. On the other hand, an Affidavit of Closure of Business is a document wherein a sworn statement is made saying that a certain business is closed down.

If the purpose is to cancel a Certificate of Registration issued by the Bureau of Internal Revenue or to cancel a Business Permit or Mayor's Permit issued by a local government unit, then an Affidavit of Closure of Business is mandatory.

Other requirements by specific government agencies are laid down on the website of the Department of Trade and Industry.

The owner of the business or an authorized officer of the business organization is the Affiant and must sign an Affidavit of Closure of Business to establish the business closure.

The Affiant must be equipped with a Secretary's Certificate if the business is a corporation or cooperative, or a Partners' Certificate if the business is a partnership before they sign an Affidavit of Closure of Business.

Once the affidavit has been completed, the Affiant must print at least 2 copies of the document, and then proceed with its notarization.

The Affiant must personally appear before a notary public and present at least one current identification document (I.D.) issued by an official agency bearing the photograph and signature of the Affiant. The Affiant must swear under oath the whole truth of the contents of the affidavit and then sign all copies of the affidavit. The Affiant will be asked to leave one original copy for the files of the notary public.

Once notarized, the Affiant may use the document as needed, i.e. to prove the closure of the business.

The following should be attached if applicable:

Yes. Since an Affidavit of Closure of Business is a sworn statement saying and declaring that a business has been closed, it should be executed or signed in the presence of a notary public. Note that without notarization, government agencies and other companies and institutions will not accept this document.

This document should be submitted to the Social Security Commission or Department of Trade and Industry if required by the said government agencies to process the business closure. An Affidavit of Closure of Business is mandatory to be submitted to the Bureau of Internal Revenue to cancel a Certificate of Registration, and the local government unit concerned to cancel a Business Permit or Mayor's Permit.

Notarization fees for an Affidavit of Closure of Business with Undertaking are typically PHP100 to PHP500.

An Affidavit of Closure of Business contains the following information:

Affidavits are governed by the 2004 Rules on Notarial Practice. For closure of Corporations and Partnerships, the SEC Memorandum Circular No. 5, Series of 2022 may apply. Further, the closure of the business must also comply with the legal processes and requirements of the BIR, SSS, DTI, DOLE, and other relevant government agencies to avoid continued assessments for taxes and prevent penalties, charges, and other financial obligations to said relevant government agencies.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Affidavit of Closure of Business - sample template

Country: Philippines