04/04/2025

04/04/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

04/04/2025

04/04/2025

Word and PDF

Word and PDF

1 to 2 pages

1 to 2 pages

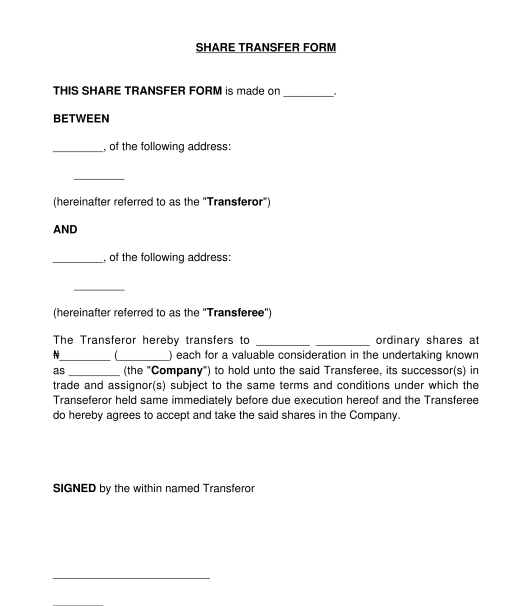

The Share Transfer Form (also called the Share Transfer Instrument) is a standard document required for the transfer of shares in a company. It is used when a shareholder intends to sell or transfer their company shares to another party.

It outlines the particulars of the party selling or transferring (the transferor) their shares to another (the transferee), the amount of shares to be transferred, the cost or value of each share, the company whose shares are transferred etc.

Shares are fixed identifiable units of capital that represent a member's stake in a company. Once a party holds shares in a company, that party becomes a member of the company with the right to transfer and transmit the shares. Note that before a party can make this transfer, that party must hold shares in that company and can not transfer more than it has.

The two major classes of shares that can be transferred are as follows:

This document is used by a party who intends to transfer their shares in a company to another party. The party transferring its shares could be a company, a person, or any other organization.

Under the law, except the Articles of Association state otherwise, a shareholder of a private company is prohibited from transferring their shares to a non-member without first offering the same shares to the existing shareholders. Therefore, if a shareholder intends to transfer their shares to a non-member, they must ensure that the company's Articles permit such transfer before completing this document.

After filling out this form, the transferor and the transferee(s) should sign this document. If either of the parties is a company, the company can affix its common seal on the document on the document, and either two directors or one director and one secretary should sign the document. Alternatively, if there is no common seal, this document may be signed, sealed, and delivered by either two directors or one director and one secretary.

If either party is any other organization, the authorized representative of that organization should sign the document.

After signing the document, the transferor must lodge this document and its original share certificate to the company whose shares have been transferred to acknowledge the transfer.

After this is done, the company should file this document at the Corporate Affairs Commission (CAC), together with a Board Resolution authorizing the transfer and a completed Form CAC 2A (Return of Allotment).

The Companies and Allied Matters Act, 2020 applies to this document. Also, the general principles of contract apply to the document.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: The Procedure for Transferring Company Shares

Share Transfer Form - FREE - sample template

Country: Nigeria