10/09/2025

10/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/09/2025

10/09/2025

Word and PDF

Word and PDF

1 page

1 page

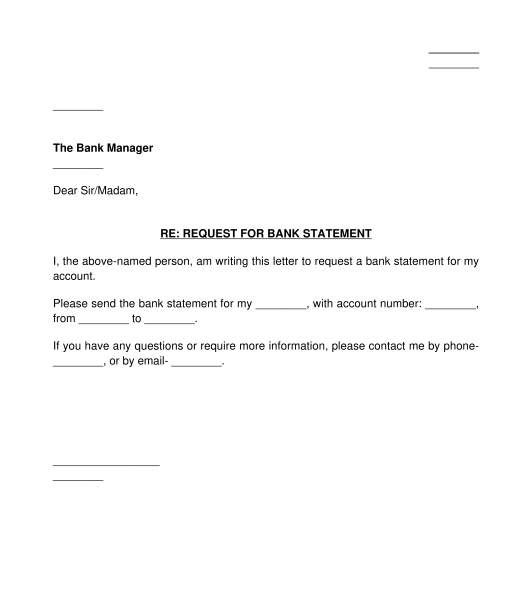

The Request for Bank Statement is a document that is used by an account holder to request their bank statement. A bank statement is a detailed information about an account holder's financial transactions. It includes the amount the account holder receives (credit) and the amount that is taken from the account (debit). An account holder may request their bank statement for many reasons. For example, a bank statement is a requirement for visa applications, scholarship/grant applications, or for personal reasons.

Every bank has the duty to release the bank statement to their customers upon request. However, such an application must be made by the account holder. This means that a third party may not make this application on behalf of the bank holder, but the bank statement may be released to a third party upon the express consent of the holder of the account.

Please note that this document can only be used for one bank at a time. If the sender requires their bank statement from multiple banks, the sender should fill out separate requests for each bank.

This is a simple document that requires vital information about the account holder/customer who is making this request. In this document, the party sending this letter should complete the following:

This information gives the bank specific instructions that should be carried out.

After completing this document, it should be printed, signed and sent to a staff of the bank. This document can also be signed electronically and sent via email. Depending on the specific bank's requirements, the sender may send this document along with a valid form of identification, like a driver's license, international passport, and voter's card. After this, the party sending this document can keep a copy for their record.

Note that some banks have a special procedure for requesting a bank statement. Therefore, before the account holder or customer can use this document, they should make enquiries from their bank about the appropriate format for this type of request.

There is no law outlining the form and content of this document. However, the Banks and Other Financial Institutions Act governs the activities and operations of banks and financial institutions.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Request for Bank Statement - FREE - sample template

Country: Nigeria