26/11/2025

26/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

26/11/2025

26/11/2025

Word and PDF

Word and PDF

2 pages

2 pages

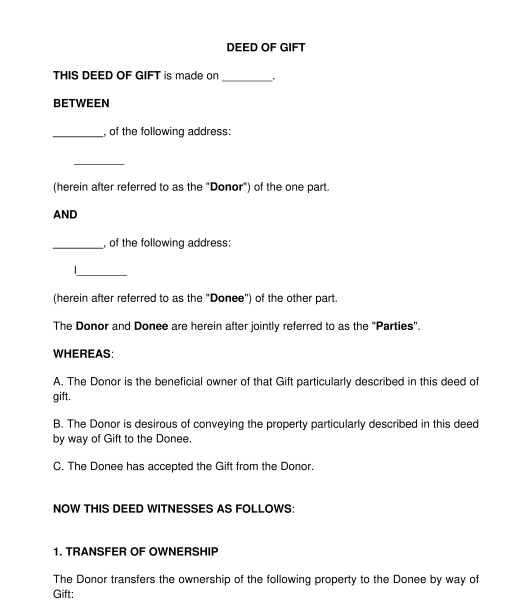

A deed of gift is used for the voluntary transfer of property from one party (the donor) to another (the donee) without consideration.

A deed of gift can be used to transfer tangible items to another party. These tangible items include personal properties, such as vehicles, jewelry, furniture, etc. It can also be used to transfer title in real property, such as lands and buildings.

By using the deed of gift, the donor transfers the legal ownership of their property to the donee by way of a gift. In other words, after the donor gifts a property to the donee, the donee retains ownership of that property.

A deed of gift can be revocable or irrevocable:

Note: Parties can sign a deed of gift where the donor decides to provide regular payment to the donee for a specific duration. This means that the deed will only be valid for that duration and will automatically be terminated when the duration elapses.

No, a deed of gift is not always mandatory for the transfer of property or assets.

However, when transferring title in real property, a deed of gift is often required as it typically needs to be registered with the Lands Registry.

The following are the essential components of a deed of gift:

The parties to a deed of gift are the donor and the donee. The donor is the party that owns the property or gift they are granting to the donee. The donee, on the other hand, is the recipient of the gift.

Either of the parties can be an individual, a company, or a registered organization. If the donor is a company or organization, they should obtain the requisite approval from the board of directors or officers of the organization before donating any gift.

Generally, minors (persons who are below the age of 18 years) cannot validly enter a binding contract, including a deed of gift.

If the donee is a minor, the legal guardian or trustee of the minor should sign the deed of gift on behalf of the minor.

A deed of gift does not have a specific duration. In fact, once granted to the donee, it is irrevocable. This means that the donor cannot change their mind about the gift.

The donor and donee should sign the deed of gift. Signature can be done by hand or electronically.

If either of the parties is a company or organization, an authorized representative (for example, a manager, director, or senior officer of the organization) of the organization should sign the deed of gift.

After signing and notarization, each party should keep an original copy of the deed of gift.

If the deed of gift is used to transfer title to real property, it should be registered at the Land Registry of the state where the property is located.

If the deed of gift relates to the transfer of title in a real property, the following documents may be attached to a deed of gift for registration at the Land Registry:

For personal properties, the donor may choose to deliver a purchase receipt or proof of ownership of the property to the donee to confirm the donor's ownership of the property. However, note that this is not a mandatory requirement.

Yes, notarizing a deed of gift is necessary for transferring real property.

However, while notarization is not a strict requirement for personal property, it is recommended for added legal protection and to prevent disputes.

Yes. However, registration is only required when the deed of gift is transferring title to real property.

Yes, the deed of gift needs to be witnessed to be valid.

After the parties have signed, the deed of gift should be witnessed by at least one person. The witness is required to hand fill in their names, addresses, and occupations and also sign the deed of gift.

The cost of finalizing a deed of gift, particularly a deed of gift intended for the transfer of real property varies, as it includes the cost of notarization, registration, the requisite taxes, and attorney fees.

It is important to consult the Land Registry for updated details of the cost.

Generally, a gift cannot be revoked unless it is a conditional gift and the condition for the gift is not fulfilled. For example, if a donor gifts the donee a property in anticipation of marriage, the gift can be revoked if the marriage does not happen.

Additionally, a gift can be challenged and revoked by a court of competent jurisdiction if it is found that:

(I) the donor did not have the legal capacity to grant the gift;

(II) the gift was given under duress or by force;

(III) the gift was obtained by fraudulent misrepresentation or mistake surrounding the circumstances.

The Land Use Act of 1978, the Property and Conveyancing Law, the Lagos State Registration of Titles law, and other state land registration laws regulate the registration of instruments transferring interest in real property.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Deed of Gift - FREE - sample template - Word and PDF

Country: Nigeria