09/09/2025

09/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/09/2025

09/09/2025

Word and PDF

Word and PDF

12 to 19 pages

12 to 19 pages

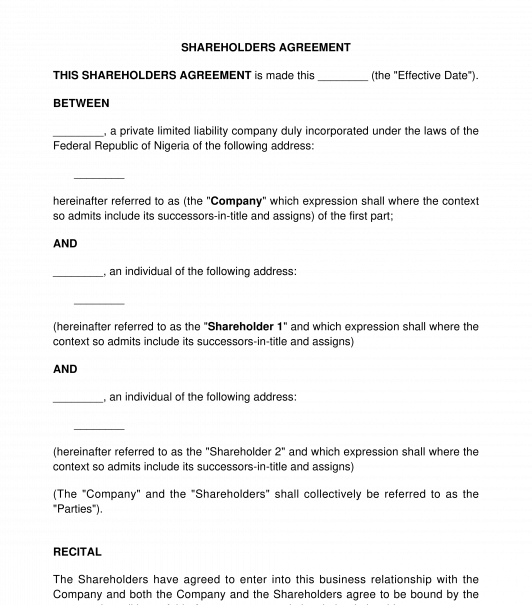

A Shareholders Agreement is a contract between a company and its shareholders outlining how the company will be managed and stating the rights, duties and obligations of the shareholders. The purpose of this agreement is to protect the rights of investors (who are also shareholders) and their investment and establish a fair relationship between the shareholders and the company.

Among other things, this agreement makes provision for the management of a company, decision-making process either at board meetings or general meetings, share sale and subscription by new and existing shareholders, the protection of a majority shareholder(s) (drag along rights), and protection of minority shareholders (tag along rights).

This document contains the following information:

- The Names and Addresses of the Parties

The parties to this agreement are the company (whose shares are being issued to the shareholders) and the shareholders. Note that a shareholder can either be a natural or a juristic person. That is, can be an individual or an organization.

- The Management of the Company

This states how the company will be managed. The document outlines the officers of the company and their duties.

- The Share Capital and Share Structure of the Company

The share capital is the finance the company obtained from the allotment of shares. This form filler will provide the share capital of the company and also the shareholding of each shareholder of the company.

- The Rights, Covenants and Representation of the Shareholders of the Company

The document specifies the rights of the shareholders such as the right to receive dividends when declared, right to vote, right to participate in the decision making process of the company, etc. The document also outlines the covenants and representations of the parties to the agreement.

- Meetings of the Board of Directors

Decisions of the directors are made at meetings of the board of directors. The document outlines the quorum, voting, and how resolutions are passed.

- Meetings of the Shareholders of the Company

The document describes the quorum and how decisions are passed at the general meetings of the company. According to the the Companies and Allied Matters Act (CAMA), there are three types of general meetings: Statutory Meeting, Annual General Meeting (AGM), and Extraordinary General Meeting (EGM).

A Statutory Meeting is a type of meeting that is held only once in a lifetime of the company and is only required for public companies. This meeting must be held at least six months from the date of incorporation of the public company, in which a statutory report will be forwarded to every shareholder of the company.

An Annual General Meeting is a type of meeting that is held once a year. The meeting is usually convened at every financial year end of the company and the ordinary business of the meeting includes the presentation of the financial report and reports of directors and auditors, declaration of dividends (if any), re-election of retiring directors, appointment and fixing the remuneration of auditors and appointing the members of the audit committee of the company.

An Extraordinary General Meeting is a type of meeting that is convened either by the directors or any shareholder who is a holder of one tenth of the paid up capital of the company whenever the need arises.

- Drag Along Rights of the Majority Shareholder

Depending on the preference of the parties, the drag along provision may be included to protect the rights of the majority shareholder. This provision enables a majority shareholder who is willing to sell its shares in a merger or acquisition, to compel the minority shareholders (who ordinarily, may be unwilling to sell theirs) to sell their shares at a fair price.

- Tag Along Rights of the Minority Shareholders

This provision allows minority shareholders are shareholders with less than 50% shareholding in the company. This provision simply states that if a third party is willing to purchase the shares of the majority shareholder, the sale will not be valid except the same offer is also made to the minority shareholders. This provision protects the minority shareholders' rights as it ensures that the shares are sold at the same price, terms and conditions as that of the majority shareholder.

How to use this document

After completing this document, the document should be signed by all the parties to the agreement and each party should have at least one copy for record purposes.

To execute this document, the company should affix the common seal of the company on the document and either two directors or one director and one company secretary should sign the document.

If either of the shareholders is a company, the company can affix their common seal on the document and either two directors or one director and one company secretary should sign the document. If either of the shareholders is any other organization other than a company, for example, a business name (sole proprietorship or partnership), incorporated trustee, etc. an officer of the organization (for example, the sole proprietor, a partner, trustee, etc.) should sign the document.

Note that this document has been revised to include the amendments contained in the new Companies and Allied Matters Act, 2020.

Applicable law

The Companies and Allied Matters Act, 2004 is applicable to this document. The rules of general contract also apply to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Shareholders Agreement - FREE - sample template

Country: Nigeria