05/09/2025

05/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

05/09/2025

05/09/2025

Word and PDF

Word and PDF

9 to 14 pages

9 to 14 pages

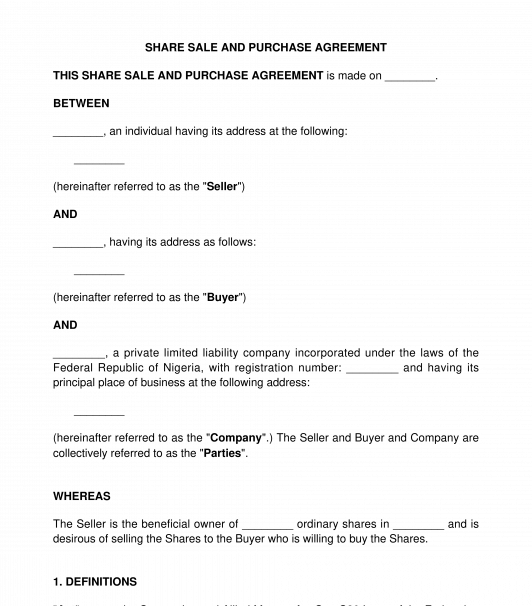

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

Shares are fixed identifiable units of capital that represents a member's stake in a company. Once a person holds shares in a company such party becomes a member of the company with the right to transfer and transmit the shares.

A shareholder can either sell part or the entirety of its shares. If the shareholder sells its entire shares, it completely divests its interest in the shares in the company and ceases to be a shareholder of the company. In the same vein, if a party sells only a part of their shares, they divest their interest in the number of shares they sold to the buyer.

What distinguishes this document from a Share Subscription Agreement is that a share subscription agreement is used in cases where a company is selling its shares, while in a share sale and purchase agreement, a shareholder of the company is selling already issued shares to another party.

The document requires vital information, such as the parties to the transaction, description of the shares, the purchase price (consideration), warranties and representations of the parties, pre-completion, and post-completion requirements.

How to use this document

This document is used when a party decides to sell part of or its entire shares to another. After completing this document, the parties should sign the document. If either of the parties is a company, the company may affix its common seal on the document and the document should be signed by either two directors of the company or one director and one secretary should sign the document on behalf of the seller.

Once all the parties have signed the document, each party should keep at least one original signed copy of the document for their record.

After a share sale and transfer, the company is required file the following document to the Corporate Affairs Commission to reflect the company's new share structure:

After the post-incorporation filing is done, the name of the buyer will be included in the company's register of members (if the buyer is not already a member of the company).

Applicable law

The Companies and Allied Matters Act, 2020 applies to this document. Also, the Investment and Securities Act and the Securities and Exchange Commission (SEC) Rules are applicable. The general rules of contract are also applicable.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: The Procedure for Transferring Company Shares

Share Sale and Purchase Agreement - FREE - template

Country: Nigeria