10/14/2025

10/14/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 951 votes

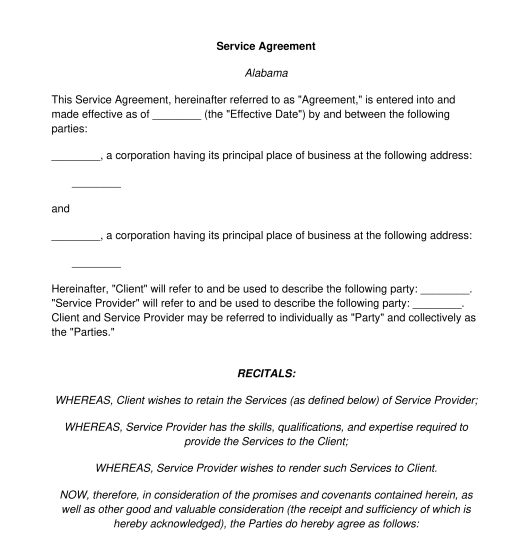

Download a basic template (FREE) Create a customized documentUnder a service agreement the service provider agrees to provide certain services to the client in exchange for payment. These can be any types of services, from small individual-oriented services like dog walking to larger more professional services like freelance accounting.

The main difference between these two contracts is the nature of the relationship created between the parties. With a service agreement, the entity providing services is usually an external service provider. They control their own work schedule, finances, and taxes. They are not entitled to receive employment benefits, such as health insurance or a retirement account. The work they do is typically on one specific project or service.

Using an employment agreement creates an employee and employer relationship between the parties. The employer exerts much more control than in a service agreement, dictating the employee's hours, tax witholdings, and pay schedule. The employee receives employment benefits and their work is broader and often indefinite.

For more information on this, please see the guide What's the Difference Between an Employee and an Independent Contractor.

Though both documents are used to outline the terms under which services will be provided to a client, there is a difference in the scope of their potential use. A service agreement is a contract that can be used broadly to contract for any types of services. A services agreement can involve any entities, including individuals and businesses or organizations. It can be applied to employees, services providers, vendors, independent contractors, or any other entity providing a service to a client.

An independent contractor agreement is a contract for a specific form of service agreement where someone is hired on as an independent contractor rather than as an employee. This usually involves a business contracting with an individual person to provide freelance services. It can only be used to create an independent contract relationship where the person providing the services full controls themselves and their payment and does not receive benefits.

No, it is not mandatory to have a service agreement in place. However, it is highly advisable as it makes sure that both the service provider have a clear idea of the services that will be provided and the terms under which this will happen. It acts as protection for one or both of the parties in case there is a problem or future dispute related to the arrangement.

A non-compete clause is an agreement, during and after a service provider's work for a client, that the service provider avoid engaging in direct competition with the client in the same industry and geographic location. Although non-compete clauses are allowed to be in service agreements, non-compete clauses that are judged by a court to be too restrictive, either in geographic scope or time frame, they may be determined to be unenforceable. A separate and extensive non-compete agreement is also available.

Both individuals and businesses may enter into service agreements. For individuals entering into service agreements, they must be of legal age to enter into a contract, 18 years of age or older in most states. They must also be mentally competent to enter into a contract. Business entities entering into a service agreement must have the legal authority to do so, usually outlined in the business' governing documents, such as bylaws or operating agreement.

Although service agreements are typically used for specific projects or services provided to a client in a limited scope, a service agreement may also be indefinite. For example, a certified public accountant could create a service agreement with a client saying that they will complete and file the client's taxes every year.

Once the agreement is complete, both the service provider and client should sign and date the service agreement. The document does not need to be notarized or witnessed to be legally binding. The parties should each save a copy of the service agreement in their files for future reference and in case of dispute or disagreement.

A valid service agreement must include at least the following mandatory clauses:

Service agreements in the United States are subject to both Federal laws and specific state laws, which cover general contract principles like formation and mutual understanding. Federal laws may restrict which services may be contracted for (e.g., no one may contract for anything illegal) and certain broad categories, like contracting for something that looks more like an employment relationship, but individual state laws usually govern the interpretation of the contract in case of a dispute.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Service Agreement - FREE - Template - Word & PDF

Country: United States