22/09/2025

22/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/09/2025

22/09/2025

Word and PDF

Word and PDF

1 page

1 page

A Notice of Retirement from Partnership document can be used by a partner who wishes to leave a partnership.

By creating a written notice of retirement, retiring partners may limit their future liability related to the partnership and the partnership may protect itself from future liabilities created by retiring partners.

If a retiring partner tries to leave a partnership but does not follow the appropriate procedures, as set out in the Partnership Act of the relevant state or territory, or in the partnership's Partnership Agreement (if applicable), then the retiring partner may still be considered a partner, and may remain responsible for future liabilities of the partnership.

Furthermore, the Partnership Act in most states and territories provides that a third party which has had prior dealings with the partnership, and which has not been informed of the retiring partner's retirement, may be entitled to still treat that retiring partner as a partner of the firm. This means that the retiring partner may still be able to do things which create liabilities for the partnership - such as borrowing money in the name of the partnership. In addition, that third party may still hold the retiring partner responsible for liabilities of the partnership. Therefore, regardless of whether the legislation specifically requires third parties to be notified, it is good practice to notify them anyway, to prevent them from continuing to treat that retiring partner as a partner of the partnership.

This document can be used for several purposes:

1. It can be provided directly to the other partners in the partnership, to notify them of the retiring partner's retirement.

2. It can be provided directly to third parties to notify those third parties of the retiring partner's retirement, so that the third party will no longer be entitled to treat the retiring partner as a partner of the partnership.

3. It can be published publicly, such as in a newspaper and/or government gazette, in order to notify other third parties of the retiring partner's retirement.

If the partnership has a Partnership Agreement, then this is likely to set out certain procedures that a retiring partner must follow in order to retire from the partnership. For example, it may require the retiring partner to provide a minimum amount of notice (for example, 14 days), before the retirement becomes effective. In addition, it might state whether or not the partnership can continue after a partner retires. In some cases, the partnership may need to be dissolved.

This document can be used both if the partnership is going to continue, and if the partnership is going to be dissolved.

Technical dissolution of a partnership

If the composition of the partnership changes (ie if a partner retires or dies, or if a new partner joins the partnership), then the partnership is dissolved and a new partnership is formed.

However, if the remaining partners (and any new partners) want to keep operating the partnership, without the retired partner, then they may be able to treat it as a "technical dissolution". The partnership may then continue as a "reconstituted partnership".

For example, this can occur when one partner wants to leave the partnership, but the remaining partners (as well as any new partners) do not actually want to close down the partnership business. Instead, they may want to keep running the partnership's business with no interruption. By going through a "technical dissolution" and creating a "reconstituted partnership", they take over the assets and liabilities of the partnership, and can keep using the partnership's same Australian Business Number (ABN) and Tax File Number (TFN).

Although the partnership has technically been dissolved and reconstituted, the partnership's business has been able to keep running as normal.

The Australian Taxation Office provides further information about technical dissolution and reconstitution of partnerships.

Dissolving a partnership

Alternatively, if the remaining partner(s) are not planning to continue running the partnership's business, then the partnership may be dissolved.

In this case, the partnership may be dissolved when one partner notifies the other partners that they wish to retire from the partnership (and those remaining partners do not intend to continue with the partnership business). This Notice of Retirement from Partnership may be used in these circumstances. The document may be adapted for use in the case of one partner retiring (ie a technical dissolution), or in the case of a dissolution (when the remaining partners do not intend to keep running the partnership business).

If the partnership is being dissolved, then the partners will also need to follow any procedures set out in the Partnership Agreement or in the relevant Partnership Act.

A Deed of Partnership Dissolution can also be used to set out the details of the dissolution, including such matters as what will happen with the various assets and liabilities of the partnership. This can be particularly useful if the partnership has been operating without a Partnership Agreement, or if the existing Partnership Agreement does not provide details about ending the partnership.

How to use this document

We have published a Legal Guide regarding How to End a Partnership in Australia. Read this guide for an overview of the various matters to be considered both before and after a partner retires, and to make sure that this Notice of Retirement from Partnership is the appropriate document for the situation.

If there is a written Partnership Agreement, this should be reviewed, to ensure that the partner's retirement conforms to the pre-established guidelines.

The following information may be included in this document:

Ensure that appropriate signature clauses are included in the document. For example, if the partners are trusts, companies, or some other kinds of legal entities, then specific signature clauses may need to be added.

Once the document has been prepared, a copy should be provided to each partner. The Partnership Agreement may specify how these notices are to be provided to the other partners (by hand delivery, by mail, by registered mail, or whether email or other electronic methods are acceptable).

Copies may also be provided to any relevant third parties (if applicable).

The Partnership Act in some states and territories requires a Notice of Resignation from Partnership to be published in a newspaper and/or government gazette, so that third parties who may deal with the partnership in future are aware that the retiring partner is no longer involved with the partnership. Further information can be obtained by referring to the Partnership Act in the relevant state or territory, or by contacting the relevant business authority in each state or territory. Links to each of these are provided under "Applicable Law", below.

If the notice is being published in a newspaper or government gazette, then this will need to be arranged. There is usually a particular procedure to follow, and a small cost to pay - but this can be determined by contacting the publication directly.

Applicable law

The following legislation governs partnerships in each respective state and territory:

Generally, when a partner retires from a partnership, or the partnership is dissolved, any partner can notify the public of that retirement. However, in some states and/or territories, (including Victoria and the Northern Territory), at least one of the partners must notify the public of the retirement or dissolution.

In addition, individual states and/or territories may have additional legal requirements when dissolving a partnership in that state or territory. Further information can be obtained from the relevant business authority in that state or territory:

If the partnership has a Partnership Agreement, then this may also set out some procedures which must be followed in relation to the retirement of a partner. General principles of contract law, as provided by the common law, may govern the interpretation and application of the Partnership Agreement.

How to modify the template

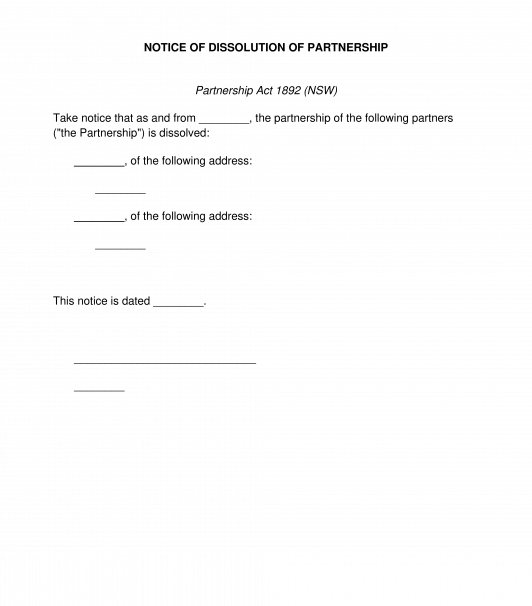

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Notice of Retirement from Partnership - sample template

Country: Australia