17/11/2025

17/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

17/11/2025

17/11/2025

Word and PDF

Word and PDF

24 to 37 pages

24 to 37 pages

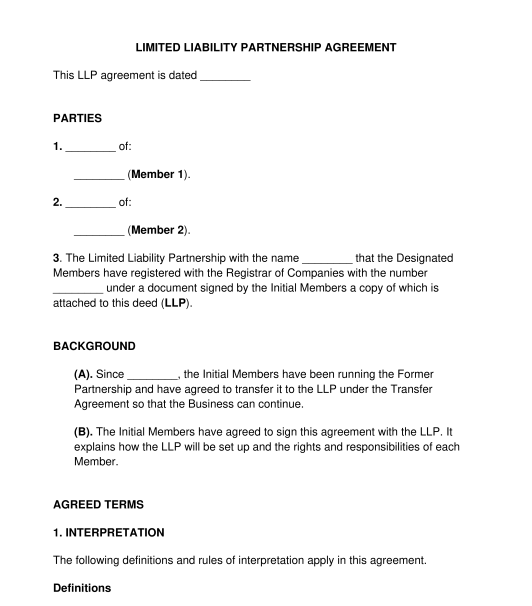

A Limited Liability Partnership (LLP) Agreement is a legally binding contract between two or more partners who intend to operate a business together with the aim of making a profit.

This agreement outlines the rights and responsibilities of each partner as well as profit-sharing structures. A limited liability partnership agreement can be created either after the establishment of a new LLP or following the transfer of an existing partnership to an LLP structure.

A General Partnership is formed when two or more partners own and manage a business together, with each partner equally responsible for the partnership's debts.

In contrast, a Limited Partnership resembles a General Partnership but requires at least one general partner who assumes full liability for the partnership's debts. A Joint Venture (JV) is a temporary collaboration between two or more parties for a specific project. Once the project is completed, the JV typically dissolves.

A limited liability partnership agreement differs from other business collaboration agreements, such as general partnerships or JVs, primarily in terms of liability and structure. In a general partnership, partners are personally liable for the debts of the business.

However, in an LLP, members are not personally responsible for the partnership's debts, as an LLP is legally recognised as a separate entity from its partners. This makes an LLP a hybrid between general partnerships and limited companies, offering the flexibility of a partnership with the limited liability protection typically associated with a corporation.

No, a limited liability partnership agreement is not legally required, however it is recommended. Also, in the absence of such an agreement, default rules governed by the LLP Regulations 2001 will apply and govern the LLP.

Members refer to the partners within the limited liability partnership. The terms "members" and "partners" can be used interchangeably.

While partners can agree on their specific roles relating to decision making, the LLP structure generally allows all partners some rights to participate in management unless otherwise agreed. Therefore, completely eliminating a partner's right to have a say could lead to legal challenges.

Before signing a limited liability partnership agreement, at least two designated members must register the LLP with Companies House.

Although designated members are responsible for completing the registration, all LLP members should ensure this process is finalised. Without proper registration, the LLP won't be legally recognised, therefore a limited liability partnership agreement cannot be completed.

Additionally, an incorporation form must be completed. Once submitted, Companies House will issue a certificate of registration. While the limited liability partnership agreement is not typically filed during registration, it is usually created and agreed upon by the members either before or shortly after registration.

Businesses including professional firms such as solicitors, accountants, and engineers, can enter into a limited liability partnership agreement. Many of these firms choose to convert from a traditional partnership to an LLP structure to protect themselves from the risk of personal liability.

This allows them to operate with the flexibility of a partnership while shielding members from being personally responsible for the firm's debts and liabilities.

Limited Liability Partnerships can only be formed by at least two members who run a lawful business with the view of making a profit. As a result, neither individuals acting alone nor non-profit organisations can establish an LLP or enter into a Limited Liability Partnership Agreement.

The duration of a limited liability partnership, whether it is intended to be perpetual or limited to a specific time frame, should be clearly defined by the members in the limited liability partnership agreement.

A limited liability partnership agreement must include:

Upon the creation of this agreement, all members should sign and date the agreement and also keep copies of the agreement for their personal records.

Yes, each member must have a witness who observes them signing the agreement. Any proposed changes to the agreement by the Members should be done in writing.

Limited Liability Partnership Act 2000

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Limited Liability Partnership Agreement - Template

Country: United Kingdom