15-09-2025

15-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

15-09-2025

15-09-2025

Word and PDF

Word and PDF

1 page

1 page

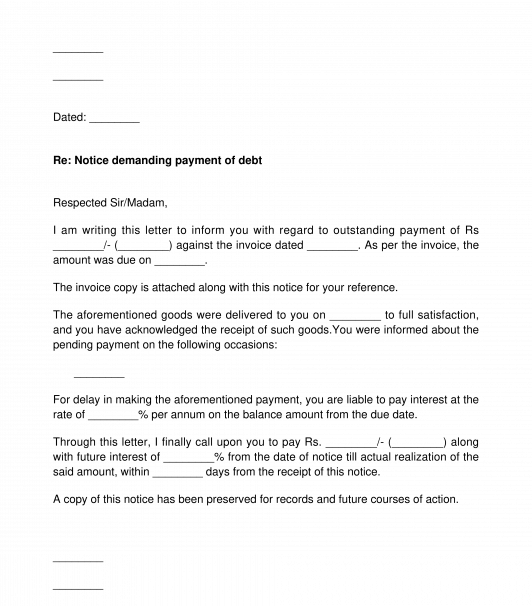

This is a formal letter demanding payment of outstanding debt. This letter can be used by any person or entity to whom money is owed ("Creditor") and needs to recover unpaid debt from an entity or person that owes money ("Debtor").

This letter can be used as a warning letter before initiating any legal proceedings against the Debtor. In most cases, the Debts are recovered through initial warning letters sent by the Creditor. Thus, sending a letter demanding debt will help the Creditor to recover debt and reduce the cost and time incurred in litigation and other legal proceedings.

How to use this document?

This letter can be used to recover any debt incurred under an invoice, agreement, and any other documents. This letter can be used even if there is no written document proving the debt.

If the debt arises based on the contract, the Creditor before sending this notice should first consult the contract itself, as perhaps the contract may stipulate a specific way of sending such a letter.

The information such as the details of Debtor, details of Creditor, outstanding balance amount, details of the document under which the debt was incurred, details of products or services provided, interest for delay in payment, and warning if the debtor fails to make the payment within a specified period.

Once the letter has been filled, the sender can send it through a registered post with acknowledgement due or to the email address of the Debtor. It is better to keep the record of acknowledgement of receipt by the Debtor for any future reference and legal proceedings.

Applicable law

The debt is protected under the general laws of the Indian Contract Act, 1872.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Letter Demanding Debt Payment - Template - Word and PDF

Country: India