10/27/2025

10/27/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/27/2025

10/27/2025

Word and PDF

Word and PDF

2 to 3 pages

2 to 3 pages

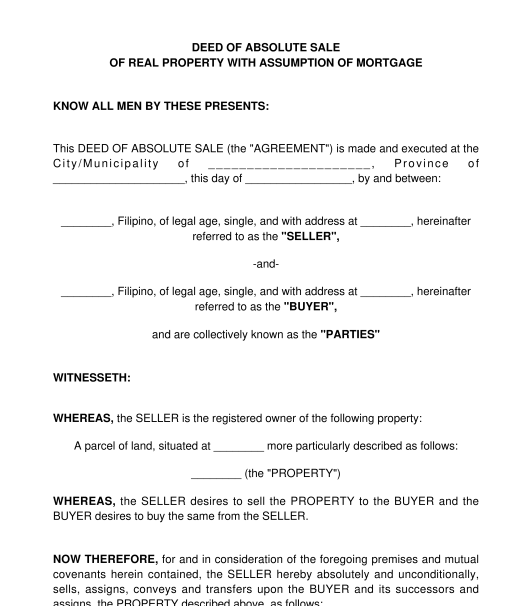

A Deed of Sale of Real Property is a document that sets forth the agreement between two parties called the buyer and the seller to transfer the ownership of the seller over a real property to the buyer in exchange for a purchase price. This document provides the terms and conditions of the sale. Real properties that can be sold under this agreement include a parcel of land, a house, a condominium, or the like.

This document may also include an assumption of mortgage where the buyer can assume or take over the mortgage that the seller has over the property. Assumption of mortgage means the buyer will continue paying off the mortgage on the property as if he is the actual mortgagor. This is usually under a deed of mortgage which uses the property as security for the payment of a loan.

This document can be used as one of the following:

The following information should be provided if applicable to complete the document:

The following should be attached if applicable:

This document should be acknowledged before a notary public, and the parties (or their respective representatives) should present themselves before a notary public with all the original copies of the document and their attachments. The parties (or their respective representatives) should also bring a competent form of identification, such as a passport or driver's license.

The notary public will keep one original copy of the document, and both parties should each keep a copy of the document for their records.

This document can be used to register the transfer of ownership of the property at the Register of Deeds where the real property is located. The Register of Deeds has other documentary requirements to register the transfer of ownership of the real property aside from the original Deed of Sale. Other requirements may include the following:

A Deed of Sale of Real Property is governed by the Civil Code of the Philippines. The 2004 Rules on Notarial Practice is also applicable if the document will be acknowledged before a notary public.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: When and how to Notarize a Document?

Deed of Sale of Real Property - sample template

Country: Philippines