10/10/2025

10/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.8 - 726 votes

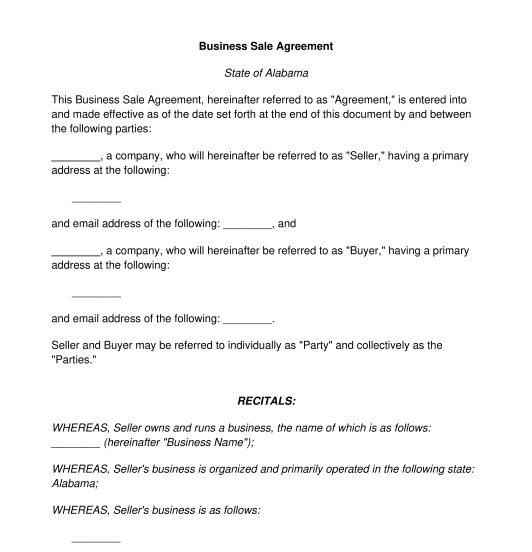

Download a basic template (FREE) Create a customized documentA business sale agreement, also sometimes called a business purchase agreement, is a document used by the seller of a company and the buyer of that company. Through the business sale agreement, the parties can outline the terms and conditions of the sale.

There are two main types of business sale agreements. The first type is known as an asset sale. In an asset sale, all the assets of the business are sold and, therefore, control and ownership of the business is sold. The second type is known as a share sale. In a share sale, all the shares of the business are sold, and therefore control of ownership is transferred. In a share sale, all the shares of the business must be sold to transfer control.

Though these documents are similar, they involve the transfer of different assets and have different final outcomes. In a business sale agreement, the buyer purchases the assets and liabilities of the business, such as inventory, equipment, or intellectual property, as well as the actual legal entity itself. If the business is sold through a share sale, the buyer purchases all of the available shares to become the new owner of the business. By contrast, a stock sale and purchase agreement involves the buyer purchasing only a portion of the available stock in a business. So, they will not have full ownership over the business.

Yes, it is mandatory to use a business sale agreement when buying or selling a business. In many states, the sale of a business must be documented in writing to be considered legally enforceable. Without a formal business sale agreement, it as if the business has not been sold at all in the eyes of the law. It is also an important document to protect both the buyer and the seller. By using a written sale agreement, both parties have in writing the specifics of the sale, which can be referred to in case of any future misunderstanding or dispute.

Assets are all the things owned by the business. These can be both tangible, like physical inventory and equipment, or intangible, like trademarks and patents.

Shares, also known as stocks, represent a portion of ownership in a business. By buying shares of a business, someone owns part of that company. The greater percentage of the total number of shares available someone owns, the greater the percentage of ownership in the business itself.

Prior to engaging in the business sale agreement, the prospective buyer should conduct thorough background research on the business to be sure that it is a sound investment. They would want to know specifically about any pending litigation or bankruptcy actions that the business may be engaged in. They should also find out the extent of the current liabilities and debts that the business owes. Before agreeing to the sale, the buyer should have a full picture of the current health of the business. This process is known as due diligence.

Once the business sale agreement has been written, it should be signed and dated by both the buyer and the seller, with a copy of the document being saved by each party. It does not need to be witnessed or notarized to be enforceable.

The parties should then go about transferring ownership by turning over any leases, bank accounts, or other assets. Depending on the form of the business, any necessary documents describing the change in ownership should be filled out and filed with the state, tax authorities, and relevant license granters. For more information about the process, please refer to the guide How to Transfer Business Ownership.

If the sale involves the transfer of tangible assets, the parties should complete a bill of sale and attach it to the business sale agreement.

The sale agreement itself does not need to be registered. However, depending on the form of the business, for example an LLC or an S Corp, the sale must be registered with state authorities using their own required forms.

A valid business sale agreement must contain at least the following mandatory clauses:

In addition to the above mandatory information, the following information may also be included:

Business sale agreements in the United States are generally subject to specific state laws. These state laws regulate the formation, operation, and dissolution of companies, which each state having its own specific laws. If the sale involves the transfer of stock, federal security regulations also govern it. The sale must comply with the Securities Act of 1933 and the Securities Exchange Act of 1934. Individual states also have what are known as blue sky laws. These laws govern the offering and sale of securities within that state.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Business Sale Agreement - FREE - Sample, template

Country: United States