09/03/2025

09/03/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.7 - 610 votes

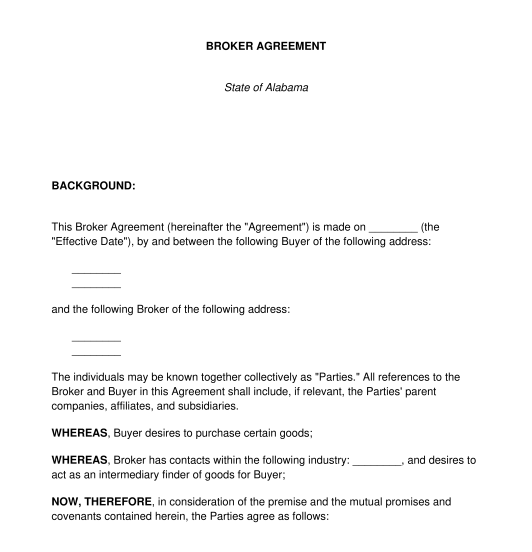

Download a basic template (FREE) Create a customized documentA broker agreement, also known as a finder's fee agreement or a referral agreement, sets forth the terms and conditions under which a broker will either find goods and/or services for a buyer to purchase or interested buyers for goods and/or services being sold by a seller.

Parties should use a broker agreement if:

Broker agreements are used for two different situations. The first type of broker agreement is for a broker helping a buyer find goods and/or services to purchase that meet their specific requirements. The second type of broker agreement is for a broker aiding a seller in finding people to purchase their goods and/or services. This broker agreement can be used for either of these situations.

Though both of these documents involve a middle man helping a buyer and seller reach a deal, they are used in different situations. A broker agreement is used for the purchases or sale of goods and/or services. A real estate agent agreement is specifically for an agent who sells real property, such as a house or plot of land, to a buyer on behalf of a seller.

No, it is not mandatory to have a broker agreement. A broker and client could have an informal understanding without creating a written contract. However, it is highly advisable as it makes sure that both the broker and client have a clear idea of the services that will be provided and the terms under which this will happen. It acts as protection for one or both of the parties in case there is a problem or future dispute related to the arrangement.

In the context of a broker agreement, exclusivity means that the client is not free to hire any other brokers to arrange sales for them while this agreement is in place.

Both individuals and businesses may enter into broker agreements. For individuals entering into broker agreements, they must be of legal age to enter into a contract, 18 years of age or older in most states. They must also be mentally competent to enter into a contract. Business entities entering into a broker agreement must have the legal authority to do so, usually outlined in the business' governing documents, such as bylaws or operating agreement.

When the broker agreement is written and all the relevant information has been included, each of the parties should sign and date the document. The parties should each keep a copy of the agreement for reference and in case of future dispute.

A broker agreement must include at least the following mandatory clauses:

Broker agreements in the United States are subject to both Federal laws and specific state laws, which cover general contract principles like formation and mutual understanding. Federal laws may restrict what services can be contracted for (for example, you may not contract for a broker to do anything illegal) and certain broad categories, like contracting for something that looks more like a business partnership than a broker/client relationship. Individual state laws may govern the interpretation of the contract in case of a dispute. Further, state-specific and industry-specific laws govern licensing and qualification of brokers in particular specialized industries. For example, in the real estate industry, the overwhelming majority of states dictate that a licensed realtor may not pay a non-licensed realtor a finder's fee. In the insurance industry, some states do not allow finder's fees. It is important, in these specialized fields, to understand the requirements and laws around finder's fees. Consider consulting an expert if you are in one of these specialized industries.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Broker Agreement - FREE - Template - Word & PDF

Country: United States