10/28/2025

10/28/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/28/2025

10/28/2025

Word and PDF

Word and PDF

1 page

1 page

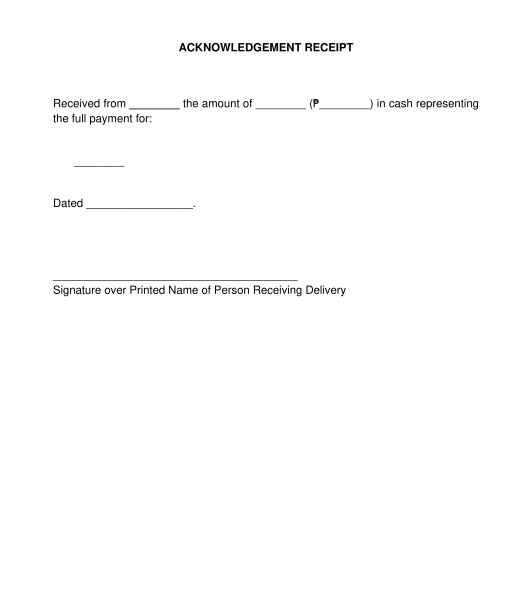

An Acknowledgment Receipt is a simple document that acknowledges receipt of cash or goods. It is usually used to record the movement of cash, documents, or goods from one person to another. It is important to note that this Acknowledgement Receipt is not an invoice that is required by the Bureau of Internal Revenue for persons engaged in business.

The headings or designation of receipts as an invoice or other types of receipts are important as these have technical meanings under tax laws. i.e. primary receipts should include the breakdown of the purchase price of the sale of goods or services, other items, and applicable value-added taxes, while secondary receipts generally do not require such breakdown of items. Further, primary receipts are recognized by the Bureau of Internal Revenue for payment of taxes or other tax purposes, while secondary receipts do not have the same recognition, and will only be used to check for discrepancies in primary receipts or invoices. For more information about this, the rules and regulations of the Bureau of Internal Revenue may be checked.

While there is no legal requirement that there be an Acknowledgment Receipt for the sale of goods and services, it is better to have one to document the transactions or to record the movement of cash, documents, or goods from one person to another. Further, it is important to note that Acknowledgment Receipts are not recognized by the Bureau of Internal Revenue for payment of taxes or other tax purposes.

The person who received the goods or cash should sign the Acknowledgment Receipt. The person who delivered such goods or cash should also be named under the Acknowledgment Receipt but they are not required to affix their signature thereon.

Once the document is completed, the user should print at least two original copies of the Acknowledgement Receipt: one original copy for the person making the delivery and one for the other person who will receive the delivery. Then the person receiving the delivery should sign all copies of the document.

An Acknowledgment Receipt contains the following information:

An Acknowledgment Receipt is generally not governed by law when it is not used by any person or entity engaged in business. Otherwise, the National Internal Revenue Code of 1997, Revenue Regulation No. 18-2012, Revenue Regulation No. 7-2024, Revenue Memorandum Order No. 12-2013, and Revenue Memorandum Circular No. 64-2015 Revenue Regulation 7-2024 (EOPT Law), among others, governs the printing and issuance of invoices and other receipts.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Acknowledgement Receipt - sample template

Country: Philippines