09-09-2025

09-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.6 - 78 votes

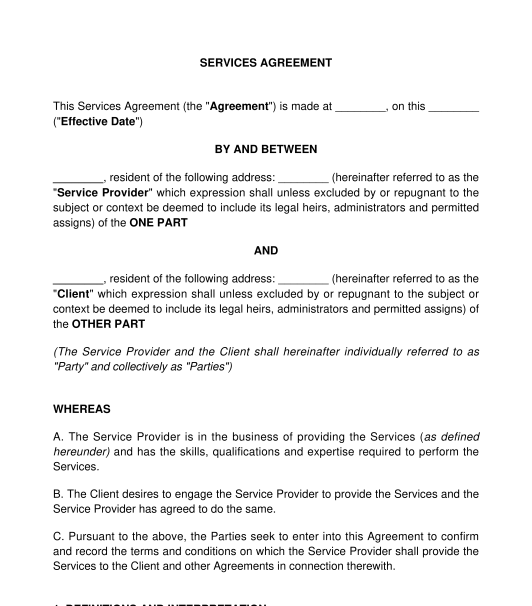

Fill out the templateA Service Agreement is a contract that governs the provision of services in return for payment or other forms of compensation. It can be utilized by individuals or organizations providing a wide range of services. For instance, it can be used by businesses engaged in building, construction, and electrical work, as well as by professionals offering coaching, personal training, consulting, and other professional services.

The Service Agreement can be used to manage a variety of service arrangements, including:

The distinction between a Service Agreement and an employment agreement mainly depended on the type of person hired for the work. A Service Agreement allows a service provider to be engaged as a contractor, while an employment agreement facilitates the hiring of the service provider as an employee, availing the provision of benefits under the applicable labour laws.

Key factors differentiating the two include the level of control, the capacity to work with other clients, the autonomy in providing services through self-owned equipment, and the provision of sub-delegation. It's important to note that utilizing a Service Agreement alone does not automatically convert an employee into a contractor.

The courts typically assess the entire arrangement to determine the nature of the engagement, considering whether the service provider operates independently as a business or functions within the business akin to an employee. For more in-depth information, a comprehensive blog on the disparities between an employee and an independent contractor can be checked.

No, it is not mandatory to have a Service Agreement. However, a well-drafted Service Agreement protects both the Client and Service provider from any potential disputes, ensures clarity on several matters and puts both parties on the same page.

There is no specified period for a Service Agreement. The period will be as mentioned under the Service Agreement such as for a fixed period, a period till the completion of a certain project, or for an indefinite period.

Once prepared the Service Agreement should be printed on non-judicial stamp paper or e-stamp paper, and signed by both the service provider and the client. The value of the stamp paper would depend on the state in which it is executed. Each state in India has provisions in respect of the amount of stamp duty payable on such agreements. Information regarding the stamp duty payable can be found on the State government websites.

Once all parties have signed, both the service provider and the client should keep a signed copy of the Service Agreement. To do this, two different copies can be signed, or if only one copy is signed, it can be photocopied and then distributed between the parties.

No, it is not necessary; however, having two independent witnesses (individuals not related to the client or service provider) will help validate the agreement or resolve any disputes in the future.

Yes, a Service Agreement can be terminated. The Service Agreement is mainly terminated on the following grounds:

To terminate a Service Agreement either party can send a Service Termination Notice to the other party.

A Service Agreement must include the following major clauses apart from the general clause mentioned in the general agreement:

The principles of the contract under the Indian Contract Act, 1872 would govern these agreements. Further, the Consumer Protection Act, 2019, also applies to all goods and services, excluding goods for resale or for commercial purposes and services rendered free of charge and under a contract for personal service. It protects the rights of customers such as the right to be informed, the right to safety etc.

Goods and Services Tax (GST) applies to the supply of services at different rates for different categories of services, other than a few exempt services. More information can be found on the GST Portal.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Services Agreement - Sample, template - Word & PDF

Country: India