09-09-2025

09-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 88 votes

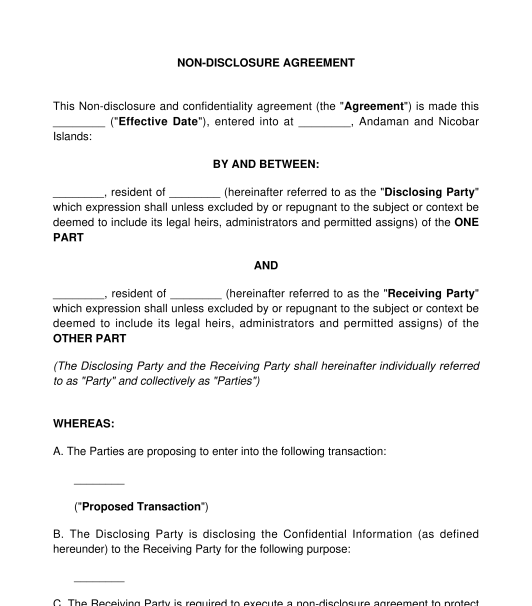

Fill out the templateThe Non-Disclosure Agreement (NDA) protects confidential information/secret information disclosed by individuals or businesses to each other during the evaluation of business opportunities, and negotiations, before investing or entering into transactions with each other. It creates an enforceable agreement between the parties that they will not disclose or use any confidential information for any purpose other than that set out in the agreement.

Non-disclosure agreements (NDAs), also known as Confidentiality Agreements, help parties feel comfortable revealing confidential information with commercial value that they might otherwise keep secret so that commercial negotiations can continue openly and honestly.

Some examples of situations where an NDA/Confidentiality Agreement might be needed include:

This is a general NDA and not suitable for employment relations.

This Non-Disclosure Agreement is often used in conjunction with a Non-Compete Agreement. A Non-Compete Agreement is a legal contract that restricts a current or former employee from engaging in competition with their employer for a specific period after their employment ends.

There are various types of NDAs, commonly categorized into the following two:

No, it is not mandatory to have a Non-Disclosure Agreement. However, it is better to always enter into a Non-Disclosure Agreement before revealing any confidential information of commercial value to other parties. This will help in protecting confidential information or business secrets and help in building trust between parties.

Once all the information has been filled in, the Non-disclosure agreement would need to be printed on non-judicial stamp paper or e-stamp paper where such e-stamp paper is available in certain states. The value of the stamp paper would depend on the state in which it is executed. Each state in India has provisions in respect of the amount of stamp duty payable on such agreements. Information regarding the stamp duty payable can be found on the State government websites.

Once the document is printed on the stamp paper, both parties shall sign it and keep a copy of the same.

Where the parties are companies, only the persons authorised by board resolutions should sign the agreement on behalf of the company.

Yes, NDAs can be terminated under certain conditions mentioned under the NDA document itself or as per the applicable law. NDA gets automatically terminated once the period mentioned in the NDA ends, mutual agreement of the parties, or a material breach by either party.

An NDA typically includes the following key clauses:

The broad principles of the contract under the Indian Contract Act, 1872 and restraint of trade apply to non-disclosure and confidentiality agreements.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Non-Disclosure Agreement (NDA) - Sample, template

Country: India