13-09-2025

13-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

13-09-2025

13-09-2025

Word and PDF

Word and PDF

9 to 14 pages

9 to 14 pages

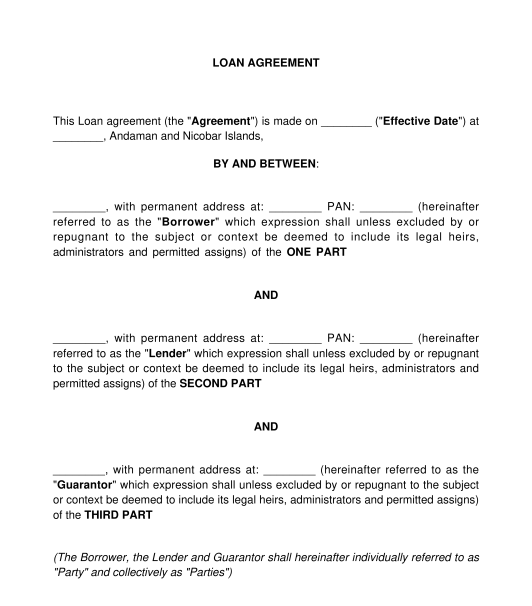

A Loan Agreement is a written promise from a lender to loan money to someone in exchange for the borrower's promise to repay the money lent as described by the Agreement.

The Loan Agreement serves as written evidence of the amount of debt and the terms under which it will be repaid.

The Loan Agreement can be used to record the terms and conditions of a loan made between individual persons or companies who are Indian citizens.

The loan agreement can be mainly divided into two types:

Loan agreement without interest: The loan agreement without interest means that the borrower needs to repay the amount borrowed without any interest. This type of agreement is often used in situations when the loan is provided to family or friends.

Loan agreement with interest: On the other hand, a simple interest loan agreement requires the borrower to pay a fixed interest on the initial borrowed amount. Under this agreement, the interest won't compound, which means interest won't be calculated on the outstanding interest amount.

Yes, it's better to have a written loan agreement in all cases. Written all major clauses will help the lender and the borrower establish their relationship and seek legal protection in case of a dispute.

A collateral or security for a loan refers to the immovable or movable property attached to the loan as security. In case, the borrower fails to repay the loan amount, the Lender can attach and sell the collateral to recover the outstanding loan amount.

The sale of the collateral could be done through public auction or other means.

Following are some of the collateral or security of a loan:

A guarantor is someone who promises to pay the borrowed amount if the borrower defaults, ensuring the lender's security and the repayment of the loan.

The loan agreement must not include any clauses with unfair terms, excessively high interest rates, or conditions that could negatively impact the legal rights of the borrower.

This includes clauses that:

If a person/entity in the business of making loans, they would need to be registered as a moneylender or with the Reserve Bank of India as a banking company or a non-banking financial company. This Loan Agreement can be used by both the registered and unregistered lenders.

Any individual or legal entity can enter a Loan Agreement.

An individual should be an Indian citizen above 18 years old, who is legally recognized as a member of the Republic of India. This status is primarily obtained by birth, descent, registration, or naturalization.

An entity can also become a part to the loan agreement, if it is incorporated or registered in India.

Loans by a foreign lender to an Indian borrower are covered under different rules and regulations. This document is not adapted for a loan by a foreign lender to an Indian company/individual.

The duration of a Loan Agreement can vary significantly based on the type of loan and the lender's policies. It can range from a few days for overdrafts to many years for home loans.

The Loan Agreement will be legally binding when it has been printed on non-judicial stamp paper or e-stamp paper, and signed by each party. The value of the stamp paper would depend on the state in which it is executed. Each state in India has provisions in respect of the amount of stamp duty payable on such agreements.

Each Party should sign and return a copy of the Loan Agreement. Where a company is a party to this agreement, they should ensure that the Loan Agreement is signed by an authorized signatory, which is usually a director as authorized by a board resolution of the company.

Where the Lender has requested that the borrower provide a guarantor, such guarantor should also carefully read the entire Loan Agreement and its guarantee obligations, and sign where indicated.

Each Party should keep a signed copy of the Loan Agreement. To do this, two different copies can be signed (or three if there is a guarantor as well), or if only one copy is signed, it can be photocopied and then distributed between the parties.

The following documents shall be attached to a Loan Agreement:

No, as a general rule loan agreement does not need registration. However, if the parties use collateral to secure the return of a debt by a borrower, the other rules apply.

If a collateral is in the form of a mortgage, in that case, it should be registered at the office of the Sub-registrar where the collateral property is located or where any of the parties to the agreement resides. The registration should be performed within a period of four months from the date of execution.

If collateral is in a form of a movable property, in that case, the registration is not mandatory. However, in case if the collateral is a car, it can be registered with the concerned RTO (Regional Transport Office) to secure the loan.

For other types of movable properties, the loan can be secured by registering with the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI).

In case of a charge being created by a company over property or instruments such as its shares, the filing must be made with the Registrar of Companies, regarding the creation of the charge.

The interest on a loan can be calculated using various methods, such as simple interest and compound interest.

Simple interest is calculated based on the initial principal amount and the interest rate. Compound interest takes into account the accumulated interest from previous periods as well.

Additionally, there are different formulas for calculating interest based on the frequency of compounding, such as annually, semi-annually, quarterly, or monthly. Each method has its own implications for the total amount repaid over the life of the loan.

The Loan Agreement must include the following clauses:

This agreement is subject to the broad principles of the Indian Contract Act, 1872.

The Companies Act, 2013 regulates the giving of loans, guarantees, or security by companies to their directors (whether directly or indirectly).

Banks are required to comply with directions issued by the Reserve Bank of India regarding interest rates that can be charged by them.

If the Loan Agreement is between an Indian citizen and a foreign person the rules and regulations of the Foreign Exchange Management Act, 1999 will apply.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Loan Agreement - Template, online sample - Word and PDF

Country: India