13-09-2025

13-09-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

13-09-2025

13-09-2025

Word and PDF

Word and PDF

19 to 29 pages

19 to 29 pages

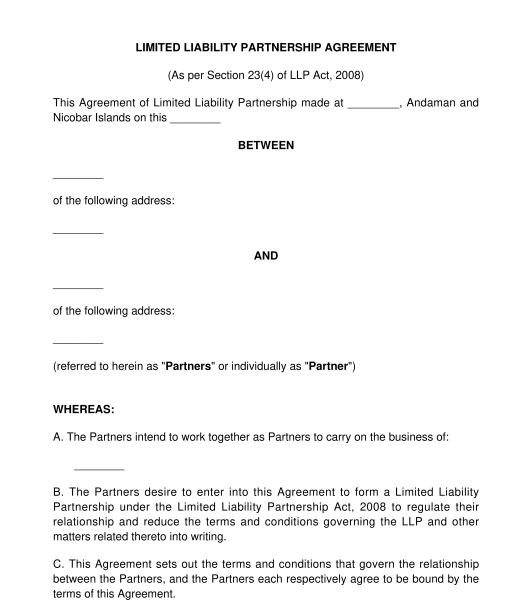

An LLP Agreement or Limited Liability Partnership Agreement is a legally binding contract between two or more individuals or businesses who would like to manage and operate a business together in order to make a profit.

The LLP can continue its existence irrespective of changes in partners. It is capable of entering into contracts and holding property in its own name. Further, no partner is liable on account of the independent or unauthorised actions of other partners, thus individual partners are shielded from joint liability created by another partner's wrongful business decisions or misconduct.

The document is crucial for establishing and running a new business successfully. It ensures clear communication and defined responsibilities for all the partners. This agreement outlines contingency plans for when things go wrong, as well as descriptions of the LLP's day-to-day operations. An LLP Agreement offers protection to the partners involved in the business and is increasingly popular for entering into a business venture.

A Limited Liability Partnership (LLP) is a business structure that combines the limited liability protection of a corporation with the operational flexibility of a partnership. The LLP is considered a separate legal entity, and its liability is limited to the full extent of its assets.

In contrast, the liability of the partners is restricted to their agreed contribution in the LLP. The Partnership created by entering into a Partnership Deed is not a separate entity, and the partners are personally liable for the losses or damages related to the partnership.

Yes, it is mandatory for LLP to have an LLP Agreement for registration. In the absence of an LLP Agreement, LLP will be registered under the standard clauses mentioned under applicable laws which may not be in the interest of the partners.

A Designated Partner is a partner appointed to fulfil specific duties and responsibilities on behalf of the LLP. These duties may include filing legal documents, managing the bank account, or representing the LLP in certain situations including in court cases, etc.

Any person above the age of 18 years or a registered entity in India can form an LLP.

There is no fixed period or duration for an LLP. The duration will be as mentioned under the LLP Agreement. It can be for a fixed period, or until terminated by partners in accordance with the LLP Agreement.

Once the LLP Agreement is completed, it must be printed on non-judicial stamp paper or e-stamp paper and signed by all the parties to the LLP Agreement and dated. The value of the stamp paper would depend on the state in which it is executed. Each state in India has provisions in respect of the amount of stamp duty payable on such agreements. Information regarding the stamp duty payable can be found on the State government websites.

All partners should keep copies of the LLP Agreement for their records. If the partners wish to change any of the terms of the Agreement, they should be sure to do so in writing.

Yes, the LLP Agreement must be registered with the Registrar of Companies where the registered address of the LLP is located within 30 days of incorporation to be a legally valid entity.

Yes, it is necessary. An independent adult must witness each partner's signature, someone over 18 years old, who is not involved with the LLP. Thus, the partners cannot witness each other.

An LLP Agreement must contain the following important clauses:

The LLP Act, 2008 is the law governing limited liability partnerships in India. General principles of the Indian Contract Act, 1872 may also apply.

As per the provisions of the LLP Act, 2008 in the absence of agreement as to any matter, the mutual rights and liabilities shall be as provided for under Schedule I to the Act. Therefore, if any LLP proposes to exclude provisions/requirements of Schedule I from the Act, it would have to enter into an LLP Agreement, specifically excluding the applicability of any or all paragraphs of Schedule I.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Country: India