01-01-2025

01-01-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.5 - 175 votes

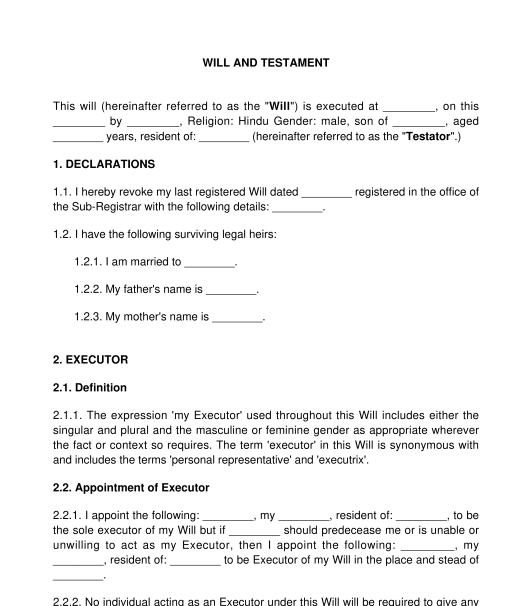

Fill out the templateA Last Will and Testament is a legal document that allows a person ("Testator") to clearly and precisely specify how the assets including belongings and property to be distributed after the death of the Testator. This allows the Testator to control who inherits or will get the assets and belongings of the Testator after his/her death. The Last Will and Testament also help in avoiding disputes among the beneficiaries or inheritors of the Testator.

Last Will and Testament are commonly used when the Testator has assets to distribute regardless of the age and wealth of the Testator. It is specifically important in various situations including:

No, having a Will is not mandatory. However, if the Testator dies without a Will, the remaining assets and belongings will be distributed as per the applicable personal laws which may not be in the interest of the Testator. A will allows the Testator to decide who inherits their assets and in what proportion. A Will is important when there are minors as inheritors and the Testator wants to appoint a specific person as the guardian (caretaker) to take care of the assets till such minors attain the age of majority.

The Testator is the person who makes the Will and outlines the wishes for what happens to their belongings and property after their death. The Testator must be a major (above 18 years old) and of sound mind while creating the Will.

The beneficiaries are the ones who are entitled to receive the belongings and properties of the Testator as per the Will. This could be family members, friends, charities, or even organizations.

An asset is anything the Testator owns that has value. This includes real estate like houses, land, etc., money in bank accounts, vehicles, personal possessions such as ornaments, watches, etc. This also includes intellectual property such as patents, copyrights, etc.

The executor also called a "personal representative" is the person the Testator trusts to handle everything after their death. The executor is responsible for paying off any debts, settling taxes, distributing remaining assets, etc. on behalf of the Testator after their death. The executor must be at least 18 years old and of sound.

The executor can be either a beneficiary under the will or a non-beneficiary. The Testator can also appoint a substitute executor to act in the absence of the original executor.

If the Testator has minor children, the Will can designate a certain person as the guardian to take care of the assets on behalf of the minors till they attain the age of majority (18 years and above). The guardian will be responsible for taking care of the minor during this period.

If a Last Will and Testament is created by a Muslim, they are unable to dispose of their entire property through the will after their death. In India, matters relating to the succession and inheritance of a Muslim are governed by Muslim personal laws. According to these laws, Muslims can only dispose of up to one-third of their property through a will without the consent of their heirs. This is after the payment of funeral expenses and debts.

In the case of Indian Christians and Parsis, the Last Will and Testament cannot be set for an unlimited period. Marriage in these religions automatically revokes a will, so a new will needs to be made.

Any person who is 18 years or older, of sound mind, and able to understand the implications of the will. The Testator should not be under the influence of substances or undue pressure at the time of making the Will.

Once the Will is prepared, the Testator shall sign the Will in the presence of two or more witnesses who are not beneficiaries of the Will and who are competent adults. Once prepared, the Will has to be stored properly to avoid any alterations or destruction.

Even though it is not mandatory, a copy of the Will can be shared with all parties involved such as beneficiaries, executors, guardians, etc. The Testator has the right to amend the Will at any time based on changes in situations.

Notarization is generally not required for a Will to be valid. However, notarization adds an extra layer of verification.

It is not necessary to register the Will. The registration of the Will with the local sub-registrar would help in increasing its authenticity. When registering a Will, a copy of the Will is kept with the registry for future reference. The beneficiaries or other interested parties can access the copy of the Will by paying the requisite fee. The registration helps in avoiding any alteration or destruction of the Will.

The Will is registered in the jurisdiction where the Testator resides. The Sub-registrar comes under the jurisdiction of the state government handling the registration of various documents including Wills.

Wills are required to have a minimum of two witnesses attesting to the Will. Witnesses must be 18 years old or above and legally competent to sign a contract. To maintain impartiality, the witnesses should not be beneficiaries of the will or have close relationships with any beneficiaries. Witnesses being a beneficiary may lead to disputes in the future.

Yes. The Will can be changed or amended by the Testator as per the change in situation or mind.

There are specific events when it's critical to review a Will, including:

A Last Will and Testament must include the following clauses:

In India, the Indian Succession Act, 1925, governs the law of succession. However, for some religions, personal laws also come into play with respect to the assets that can be given away through a will. For instance, matters relating to succession and inheritance of a Muslim are governed by Muslim personal laws. The general rule under Muslim personal laws in India is that a Muslim may, by his will, dispose of only up to one-third of his property which is left after payment of funeral expenses and debts without the consent of his heirs. Similarly, in the case of Indian Christians and Parsis, upon marriage, a will stands revoked so needs to be made again.

If the Will is registered with the Sub-registrar the Indian Registration Act,1908, will govern the provisions of such registrations.

Further, the process of writing the will can also be video recorded, and a video recording of the making of a will is admissible for evidence under the Indian Evidence Act, 1872.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Last Will and Testament - Template - Word & PDF

Country: India