27-01-2025

27-01-2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

27-01-2025

27-01-2025

Word and PDF

Word and PDF

6 to 9 pages

6 to 9 pages

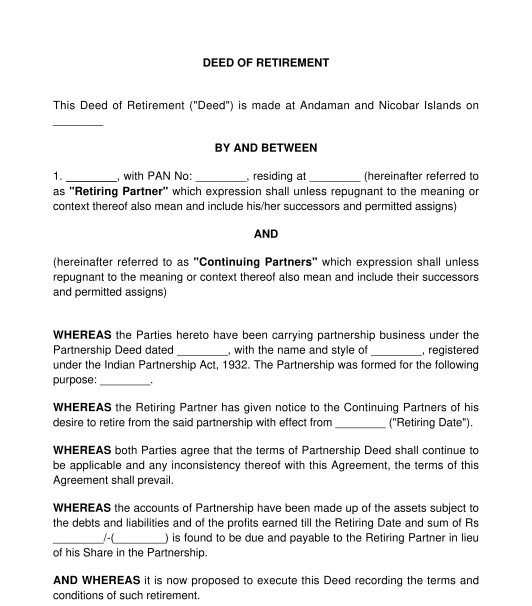

A Deed of Retirement from a Partnership is an Agreement entered into between the Retiring Partner (the partner leaving the partnership) and the Continuing Partners (the Partners who will continue in the partnership).

This Deed can be used for any type of Partnership Firm. Generally, the retirement of the Partner will not close down the Partnership (except if there are only two partners) and the Partnership continues to exist with new terms. The Deed of Retirement from a Partnership addresses the distribution of properties or valuables, liabilities, and responsibilities among the remaining partners.

The Deed of Dissolution of a Partnership Firm is used when the Partnership dissolves or closes down all business activities and the books are closed permanently. It focuses on winding up the business, distribution of assets and settling the liabilities of the partnership.

But, in the case of the Deed of Retirement from the Partnership, if there exists more than one Partner in the Partnership, the remaining Partners continue to do the business with updated terms and conditions.

No, it is not mandatory. However, having a written Deed of Retirement from a Partnership helps prevent misunderstanding and disputes in future.

Before entering into a Deed of Retirement from Partnership, the following things need to be checked:

The original partners who are part of the existing partnership agreement or their authorized representative can enter into this Deed of Retirement from Partnership. The authorization can be provided through a general power of attorney or by passing a board resolution.

The duration typically covers the period from the signing of the deed until the retirement process is fully completed and all conditions are fulfilled.

To be a valid contract, both the Retiring Partner and Continuing Partners must duly sign this agreement on an appropriate stamp paper as defined under the rules and regulations of the states where the agreement is entered into.

The retiring partner will not be relieved from the liabilities of the firm unless a public notice informing about the retirement has been duly published in a regional language newspaper. Such publications shall be where the principal place of business of the partnership is located. Such notice shall also be published in the official gazette.

If the partnership is registered, a notice must be sent to the concerned Registrar of Firms where the partnership was registered.

The following documents can be attached to a Deed of Retirement from Partnership:

The Deed of Retirement from the Partnership must include the following clauses:

The Indian Partnership Act, 1932, defines the rules related to the Partnership and retirement of Partners. The rules under the Indian Contract Act, 1872 may also be applicable.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Deed of Retirement from Partnership - Sample, template

Country: India