03/09/2025

03/09/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

03/09/2025

03/09/2025

Word and PDF

Word and PDF

26 to 40 pages

26 to 40 pages

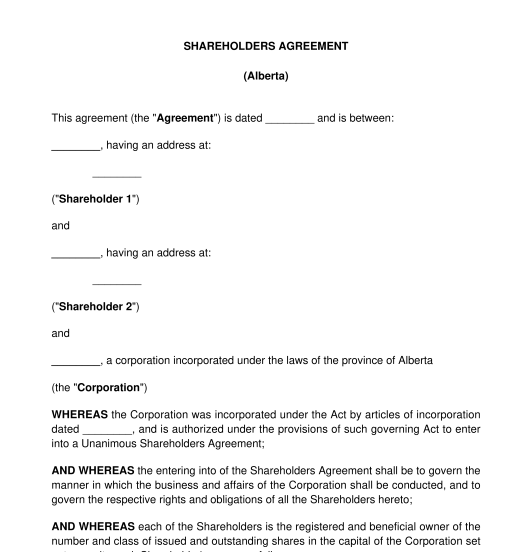

A Shareholders Agreement is a document between the shareholders of a corporation. These agreements lay out the expectations of the shareholders and their obligations. The shareholders establish the rules and the set up for the major players in the corporation.

This Agreement addresses not only potential shareholder issues, but also the day-to-day activities of the corporation.

No. Having a Shareholders Agreement is not mandatory, but it is a very useful tool. Shareholder Agreements are very vital documents for a corporation. They dictate the rules of the game, such as shareholders' rights to sell their shares, the rights concerning divorces, estate planning matters, and more. Shareholder Agreements are used for large or small corporations.

If there's a dispute among shareholders and they don't have a shareholders agreement, a shareholder will need to go to court and have a judge decide the matter.

For example, if there's a shareholder dispute and one shareholder no longer wants to part of the corporation, they can't force another shareholder to buy their shares without a valid shareholders agreement in place.

A Shareholders Agreement outlines the basic responsibilities of the corporation, including when the corporation should submit a budget, when its directors should meet and how decisions may be taken by the directors. A Shareholders Agreement may also contain:

To be able to enter into a Shareholders Agreement, the people agreeing must be shareholders in the corporation. This means that after the corporation was established, the corporation issued shares to the shareholder signing the agreement. Proof of share ownership usually takes the form of a share certificate or a notice sent by the corporation if the corporation doesn't issue share certificates.

Only the shareholders of a corporation can enter into and sign a Shareholders Agreement. The individual signing must also be of majority age. The shareholders signing the agreement may be:

Those who are not shareholders in the corporation cannot enter into a Shareholders Agreement. Also, if an individual is under the age of majority or under disability, they cannot legally contract, and therefore, they can't enter into a Shareholders Agreement. Furthermore, entities that are bankrupt or insolvent may not be able to contract.

A shareholders agreement typically lasts for the lifetime of the corporation. In other words, until the shareholders decide to dissolve the corporation, or until it is wound-up, the agreement will remain in place. Alternatively, the shareholders may provide a fixed term for the agreement with an option to renew. A fixed term may allow the shareholders to revisit the agreement and make changes before renewing.

A Shareholders Agreement may be signed when a corporation is incorporated and before it starts to take on normal daily business activities.

After the corporation is created and shares have been issued to shareholders, the shareholders may enter into an agreement.

Conversely, an older corporation that does not yet have an agreement in place may sign a Shareholders Agreement to better establish the management of the corporation. The shareholders may also decide to enter into a shareholders agreement following a dispute.

Once the agreement is ready, the shareholders must sign the document either electornically via email or in person. The signature choice depends on matters of convenience, preference, and security. An electronic signature may be simpler and less time-consumming for the shareholders. Each shareholder must then keep a copy of the signed agreement for their records.

Corporate law is governed by federal law, each Province's or Territory's legislation, and case law. In other words, the law applicable to a corporation depends on where it has been incorporated. The pieces of corporate law legislation that apply to each jurisdiction are as follows:

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Shareholders Agreement - Template - Word & PDF

Country: Canada (English)