19/10/2025

19/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

19/10/2025

19/10/2025

Word and PDF

Word and PDF

2 to 4 pages

2 to 4 pages

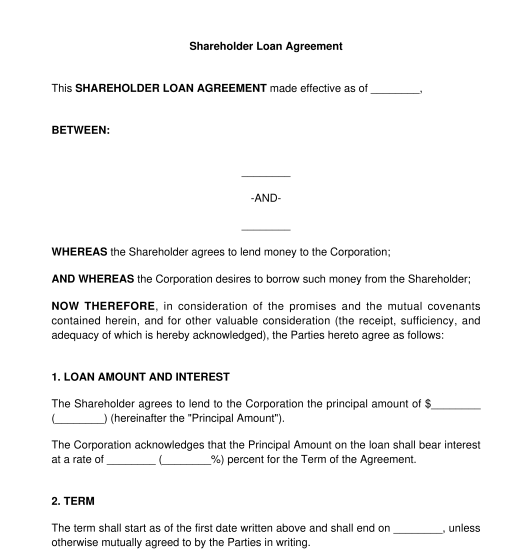

A Shareholder Loan Agreement is a document used when a shareholder lends money to a corporation. The loan could be for any reason related to the corporation's business activities, such as purchasing new inventory, equipment, or assisting with ongoing obligations.

A Shareholder Loan Agreement must contain the following:

A shareholder loan agreement is a very specific contract that applies only to shareholders of a corporation. The shareholder is agreeing to lend money to the corporation in which it owns shares. On the other hand, a Loan Agreement is a document used for general loans between any borrower and lender, and the loan can be for any reason. For example, a small business corporation can make a loan to a colleague, friend, family member, or anyone else in need of money.

Only the shareholder lending money and the corporation receiving the loan can enter into a Shareholder Loan Agreement. The shareholder may be either:

The signatories to the contract must be at least majority age and not under disability. The ages of majority are as follows:

After a Shareholder Loan Agreement is ready, both the shareholder and the corporation must sign the document, either electronically or physically. Each party will need to keep a copy of the document for their records.

A Shareholder Loan Agreement is governed by the applicable business corporations act, general contract law, the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)), and more. The applicable statute depends on where the incorporation took place. The pieces of legislation governing shareholders and corporations are as follows:

Additionally, interest rate cannot be charged in excess of the amount prescribed for under the Criminal Code (R.S.C., 1985, c. C-46).

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Shareholder Loan Agreement - Template - Word & PDF

Country: Canada (English)